Hi all,

I want to share a clear guide that helps you understand big world cycles and what you can do about them. I study how history repeats itself and how big patterns shape money, power, and our lives.

In today’s letter, I will explain five main forces that move countries and markets. I will also give simple advice you can use to protect your family, your money, and your future.

THE FIVE BIG FORCES THAT SHAPE HISTORY

The big forces are like five giant winds that push countries and economies around.

Money and debt

This means how much credit people and governments use. When people borrow and spend, the economy grows. But debts must get paid back. If debts grow too big compared to how much people earn, trouble starts. Big debt can squeeze people and create financial stress. That makes it hard to pay for schools, health, or defense.

Internal conflict and politics

When rich and poor get farther apart, people fight about rules and power. This fight can be between left and right, or between groups who feel left out and groups who hold power. When trust in the system falls, countries get messy inside. People stop following the same rules, and that breaks public life.

International power and geopolitics

Countries also compete with other countries. Big powers can rise and challenge old powers. That can lead to trade battles, tense politics, and sometimes war. Who controls new technology often decides trade rules, security plans, and alliances.

Acts of nature

Storms, droughts, floods, and health crises can change everything fast. Big natural shocks have sometimes killed more people than war. These events can break food supplies, move populations, and push politics and money into new shapes.

Human inventiveness and new technology

New ideas and tools lift living standards. But they also change who wins or loses in the world. The country or company that leads a new technology gets many advantages. New tech can make life much better but also bring hard changes for jobs and politics.

THE 100 YEAR CYCLE IDEA

I use a simple frame that W. D. Gann also follows. If you don’t know, Gann is the most accurate market forecasters of the early 1900s who made $50 million in the early 90s, equivalent of $1.8b now.

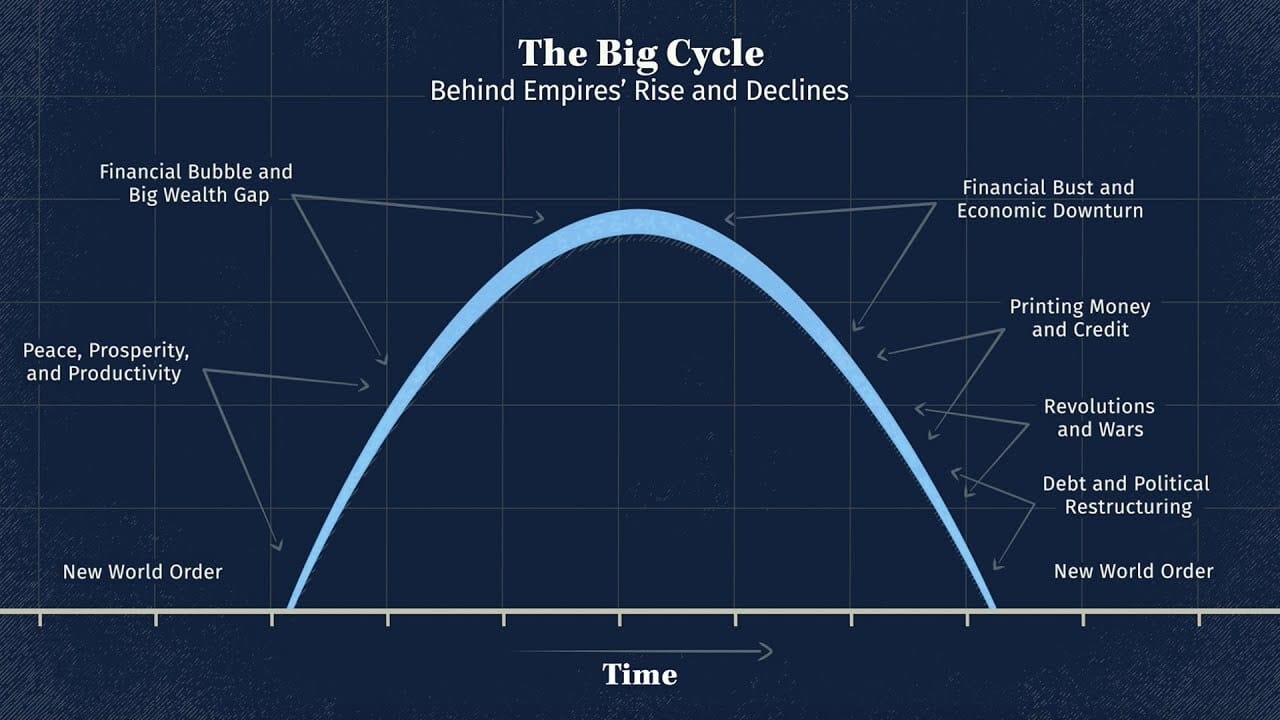

This cycle is called the life cycle. It is like a long human life for countries. Every 100 years, markets echo their past because human behavior and emotion reset across generations.

On average, these big cycles last many decades. You can think of about 100 years as one big cycle for empires and major orders. That is only a guide. The exact timing changes. But the pattern of rise, peak, decline, and replacement repeats in many places and times.

Here are some examples of how things repeat every 100 years:

1814 and 1822 vs 1918 and 1922: Crop failures, war, epidemics vs Famine, influenza, political upheaval

1819 vs 1919: First steamship crossing Atlantic vs First British airship Atlantic flight

1870 vs 1970: Railroad and land bubbles burst vs oil shock and stagflation

1873 vs 1973: Panic vs Stagflation Recession

1890 vs 1990: Rail and Industrial Crash vs Dot com crash

1907 vs 2007: Both credit panics

1920 vs 2020: The 1920 mid land cycle crash was right after the Spanish flu and it induced lockdowns similarly to what we had in 2020.

1926 vs 2026: Each represents the final act of the land cycle, where debt and speculation reach their climax before resetting.

HOW THE FORCES WORK TOGETHER

These five forces do not act alone. They push and pull each other. For example, too much debt can feed political anger. That anger can hurt the economy and make it hard to invest in technology. Or a new war can force countries to spend more on defense, which changes money and debts. Acts of nature can speed up these problems. The winner in technology gains strength in many ways: trade, military, and money.

WHAT THIS MEANS FOR DIFFERENT COUNTRIES

Not every country is the same. When a big storm hits the world, some places weather it better. Why? Because they have more savings, better education, stronger capital markets, or are more innovative.

Why some places do better

⭐ Have strong markets that let good ideas get money

⭐ Have cultures that reward inventors and risk takers

⭐ Keep many people productive through good education

⭐ Have a political middle that can act and solve problems

Why some places fall behind

⭐ High debt and deficits

⭐ Big gaps in education and opportunity

⭐ Less investment in new tech and startups

⭐ Political split and low trust

A SHORT LOOK AT TWO EXAMPLES

The United Kingdom

There are long term challenges there and Ray Dalio has expressed his concerns too. The country has been carrying debts and political fights. Its capital markets are not as big as they used to be for new ideas at scale. Education and opportunity gaps make internal conflict worse. This does not mean the country is finished, but it does mean it faces real hurdles if it wants to grow again.

The United States

The US has amazing inventiveness and big tech companies. But it also faces big debt, strong political division, and the stress of global rivalry with other large powers. Inside the US, a small share of people earn most of the gains. A large share of the population has weak basic skills and low productivity. This creates risk and makes it harder for democracy to work smoothly.

Today the big fight is about technology. The country that wins in advanced tech gains military strength, richer companies, and more global influence. This contest is one of the clearest drivers of future change. It is not guaranteed which side will lead. Much depends on education, capital, and how people respond.

HISTORY TELLS US IT IS POSSIBLE FOR POWERS TO CHANGE

History shows empires rise and fall. The same lessons apply today. Change is normal. The future often looks like a small change from the present until a turning point happens. That is why it pays to study history and patterns.

🇵🇹 1400s - 1500s: The Portuguese Empire

🇪🇸 1500s - 1600s: The Spanish Empire

🏛 1600s – 1700s: The Dutch Empire (Netherlands)

🇬🇧 1700s – Early 1900s: The British Empire

🇺🇸 1900s – Today: The American Empire

WHAT I THINK ONE SHOULD DO AS AN INDIVIDUAL

Subscribe to Smart X Insider to read the rest.

Become a paying subscriber of Smart X Insider to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- ✅ Ad-free and Exclusive Reports with non-restricted Access

- ✅ Stock & Asset Value Analysis

- ✅ Cycle Positioning Dashboard and Report

- ✅ Early Access to Smart X Capital Platform