Hi all,

Right now governments are lowering the entry bar for first-time buyers and that will push a big, short-lived wave of demand into a market that has very little supply.

WHAT JUST CHANGED

The government has made it easier for people to buy homes with very small deposits. I want you to understand three facts right away.

First, buyers can now put down as little as five percent and avoid mortgage insurance. That makes buying much cheaper up front.

Source: PM Gov

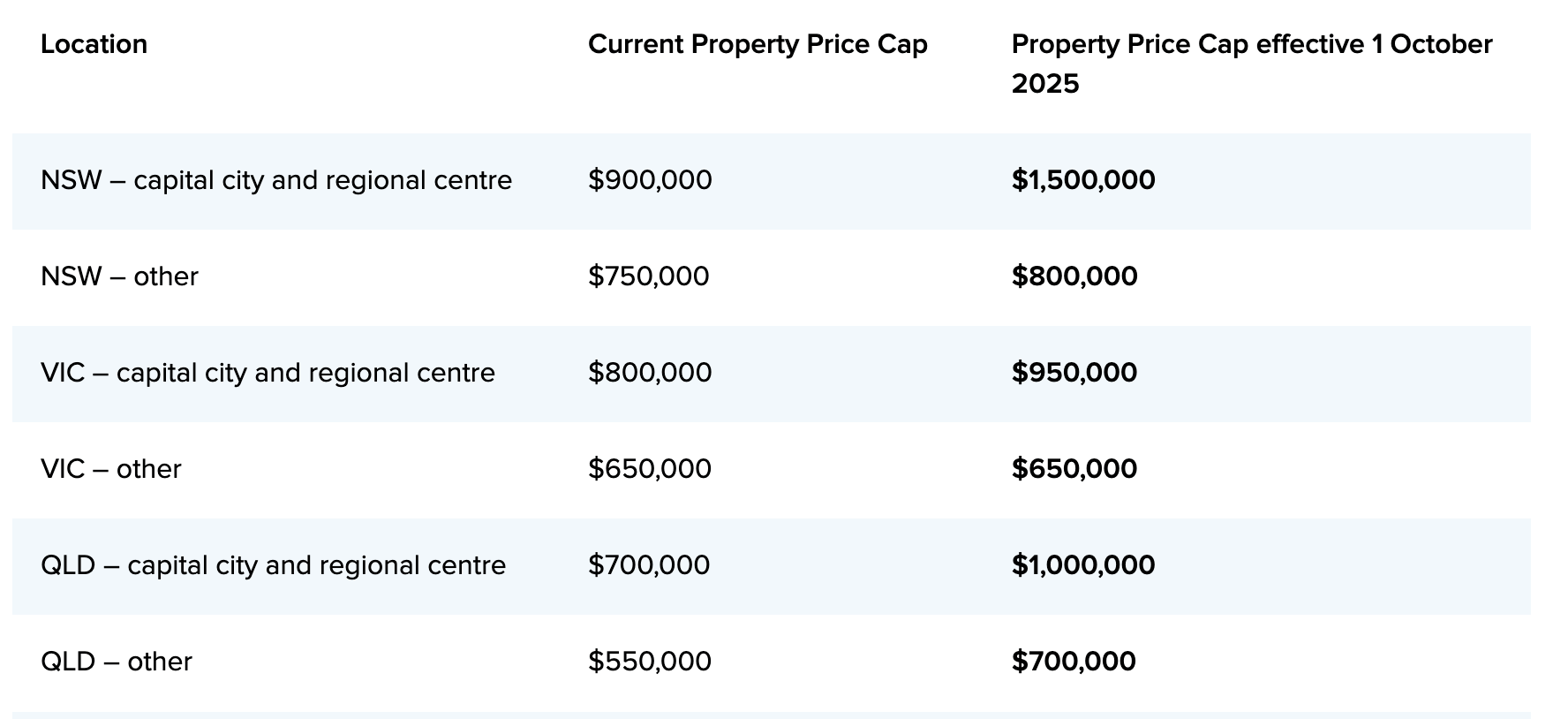

Second, the income and annual caps that used to limit who could use the program were removed, and the price limits on eligible homes were raised in big cities.S

Source: Housing Australia

Source: Housing Australia

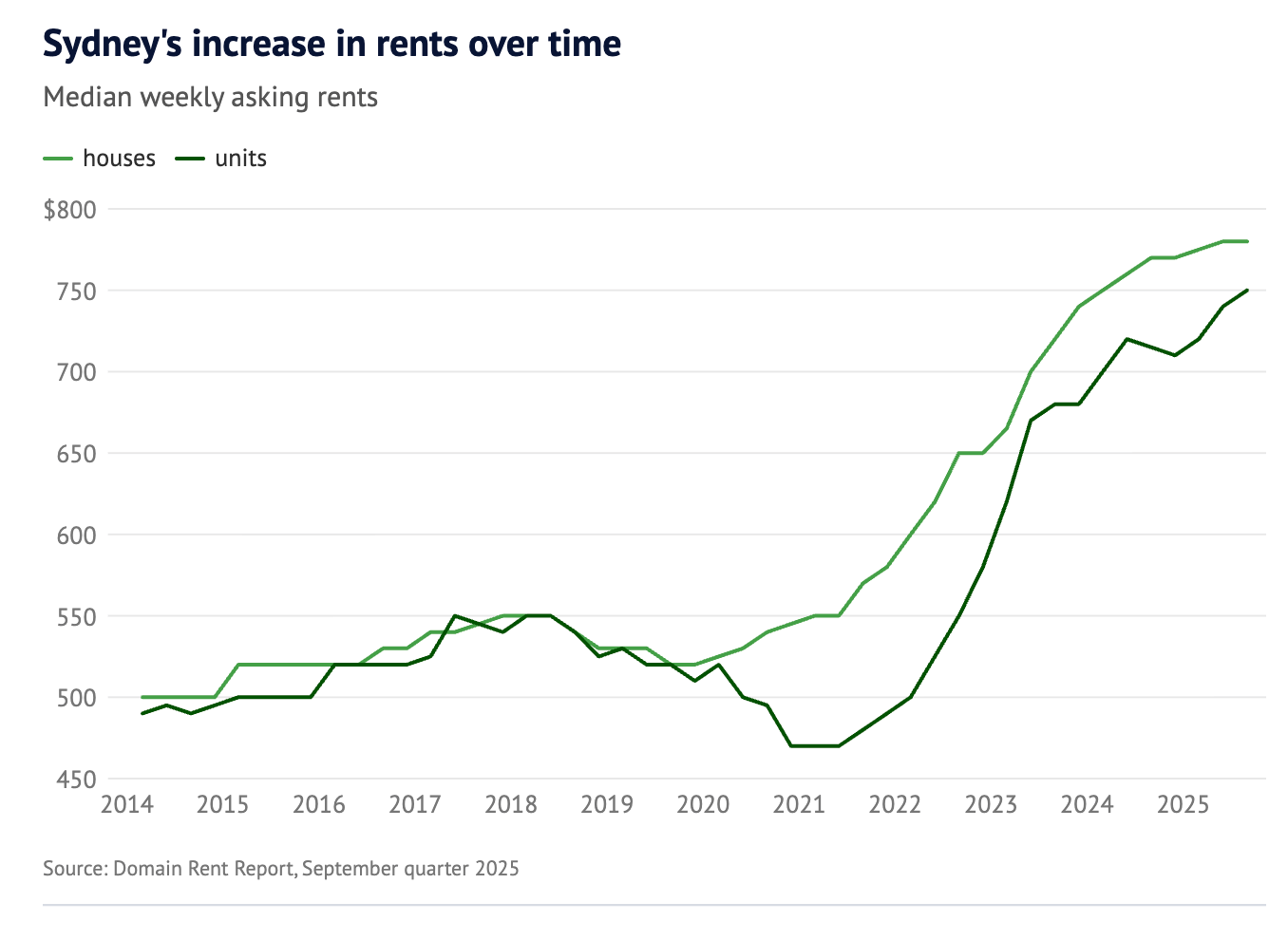

Third, because rents have jumped a lot, many renters who saved a little cash now find owning cheaper than renting in some places.

Source: Sydney Morning Herald

All of that equals more people rushing to buy, faster.

WHY THIS MATTERS

When new demand hits a market with low supply, prices and sales activity spike fast.

That spiking does a few things.

It raises prices at the bottom first.

People who sell their entry-level homes unlock equity and then buy into higher-priced brackets, pushing up the whole ladder.

It also increases leverage in the system because many new buyers will have small down payments and long loans.

This can feel good for a while, but it also adds risk if interest rates or incomes change.

HOW FAST AND HOW LONG

From past programs we can see the likely pattern. When governments hand out demand-side support like grants or deposit relief, it usually creates a front-loaded boom.

History shows the fast part generally lasts about six to eighteen months. After that, the support is priced into the market, take-up slows, and activity cools.

Past examples include programs in the 2000s and the large stimulus in 2020 which pulled building and sales forward for roughly a year or so.

2008–09 First Home Owner Boost (FHOB):

In late 2008, the government gave extra money to help people buy their first home. Lots of people rushed to buy — by mid-2009, almost half of all home sales were from first-time buyers. But when the bonus was cut back and ended in late 2009, the rush stopped. Prices stayed high for about a year, then things cooled down.

2000 First Home Owner Grant (FHOG):

Back in 2000, when the new GST tax started, the government also gave people money to help buy homes. That made more people buy houses quickly, so prices went up for about a year. But after that, the market went back to normal — it didn’t really make owning a home easier in the long run.

2020–21 Home Builder Program:

During COVID, the government gave time-limited bonuses to people building new homes. That caused a big spike in home building during 2020 and 2021 — the biggest ever in one year! But once the program ended and interest rates went up, construction dropped fast and hasn’t returned to those levels since.

Based on when this new grant starts, we can expect house prices to jump from around June 2025 to June 2026. After that, the government or the central bank might raise interest rates to cool things down if prices rise too fast.

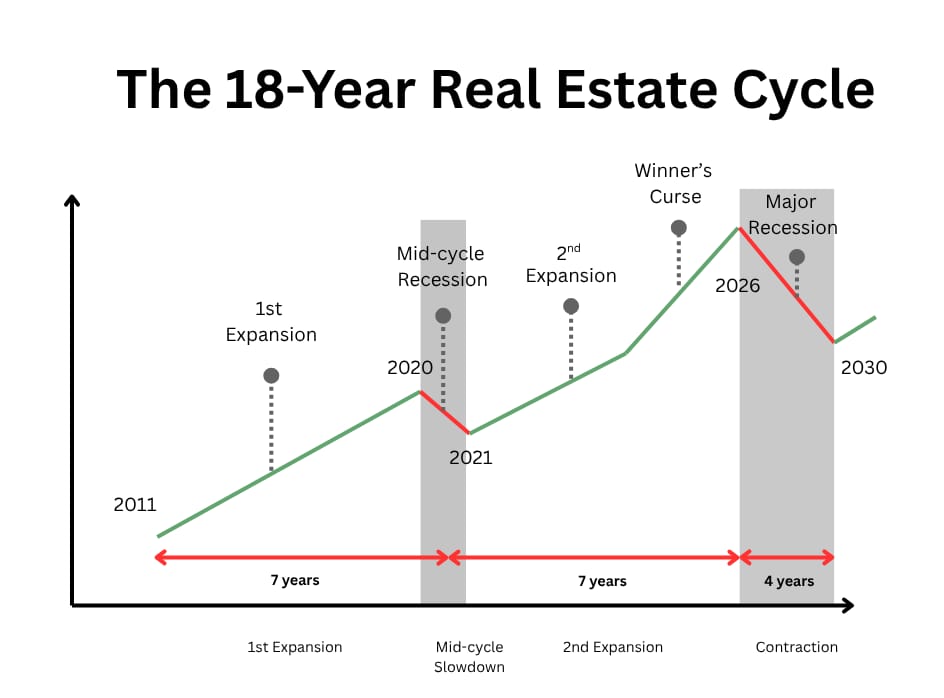

That’s why this is being called “the final countdown” — it’s the last big rush before the next land cycle crash. This marks the final stage of the low of 2010 to the low of 2028 property cycle, before everything resets again.

SUPPLY IS TIGHT RIGHT NOW

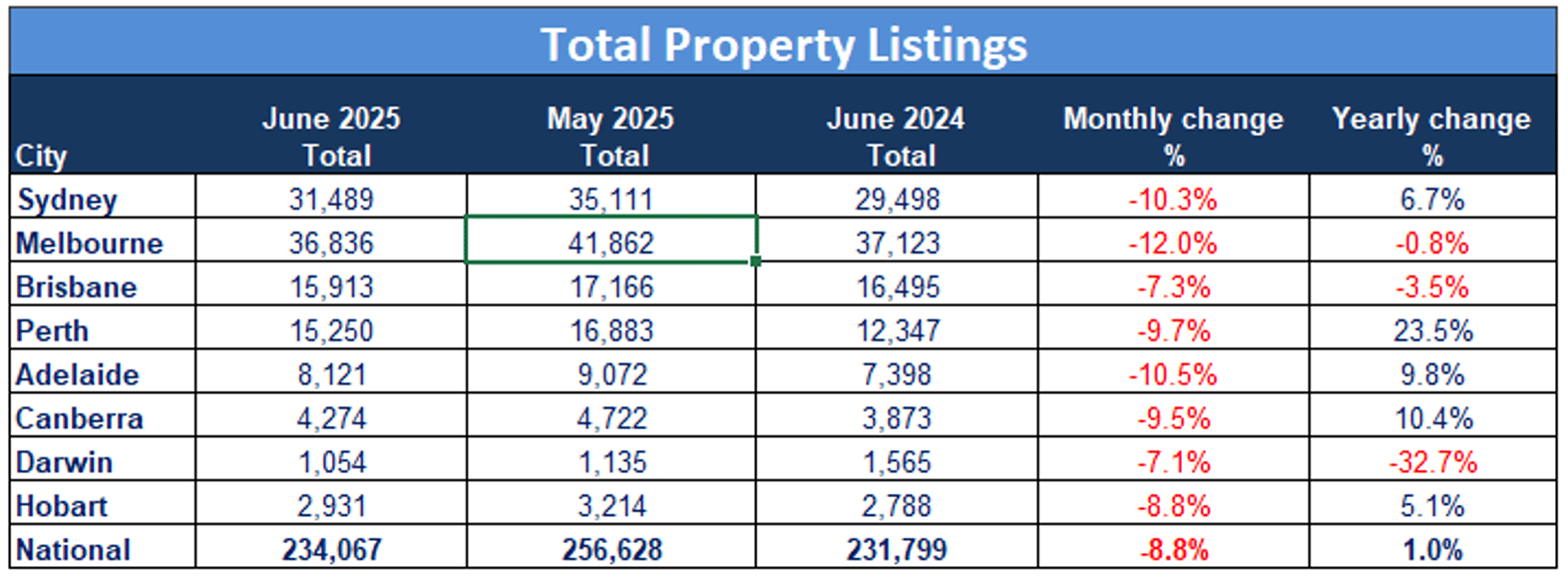

Listings are down in many cities. Agencies in some markets are getting multiple offers on properties again.

New supply from construction is also slow to arrive because projects take longer to finish than they used to. That means even if builders are starting more projects, completions are lagging, so there is less real housing available right now.

TWO SIMPLE ECONOMIES

Think about two different machines inside the whole economy.

The first one is the real machine — it makes things people use every day, like food, houses, cars, and apps. This is where jobs and real value come from.

The second one is the money machine — it doesn’t make things, but it moves money around through loans, banks, and investments like houses and stocks.

When the money machine grows too big, it can start to hurt the real machine, because more of everyone’s income goes to pay interest and rent instead of buying things or building new stuff. Ray Dalio says that’s when the economy gets “out of balance,” and it often leads to a slowdown or a crash until both machines match up again.

WHY TURNOVER IS MORE IMPORTANT THAN PRICE

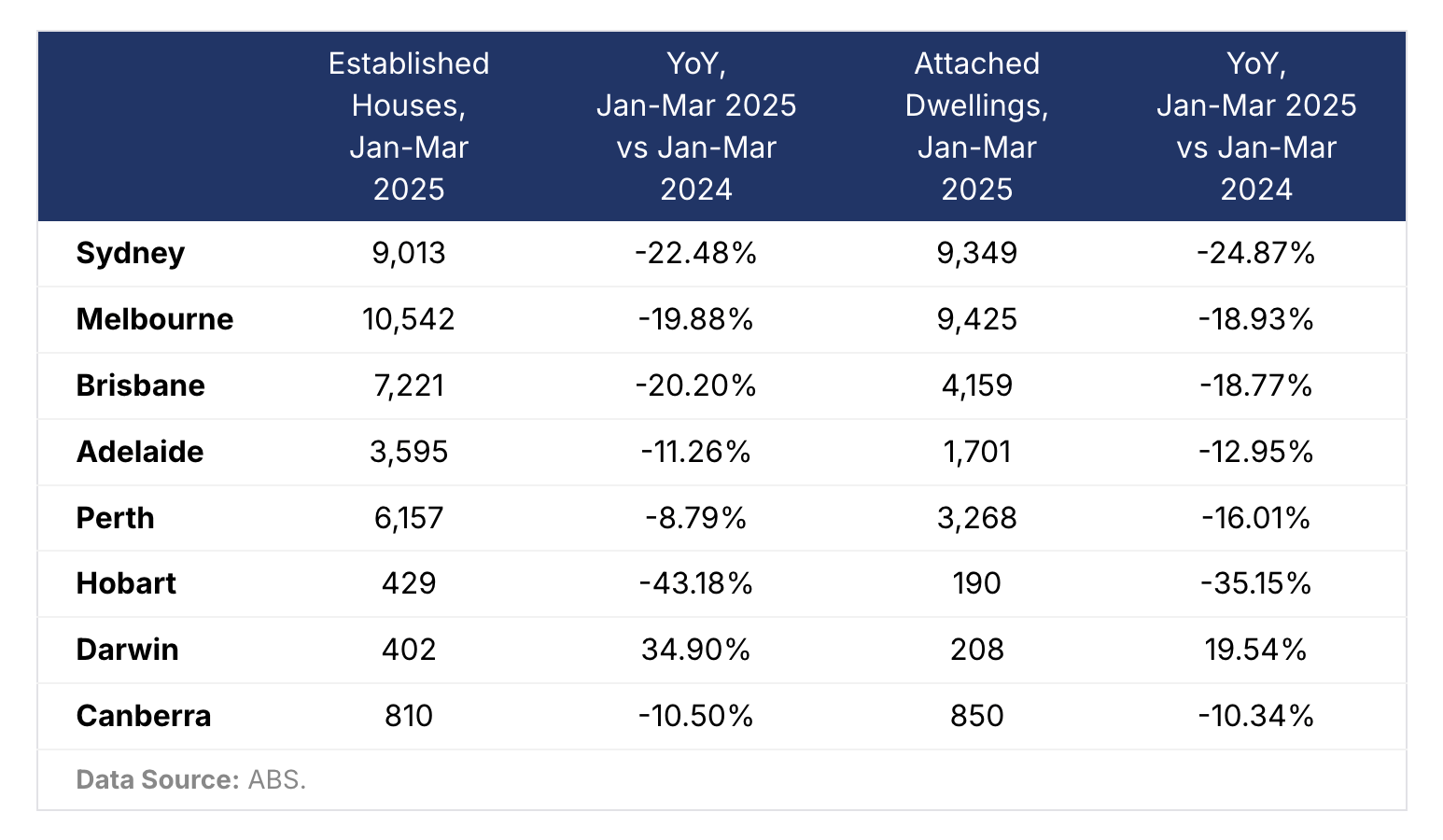

People fixate on headline prices and auction clearance rates, but a better warning sign is turnover — the amount of buying and selling.

When the number or value of transactions falls sharply, the industries that rely on moving property — agents, builders, lenders, movers, furniture shops — slow down. That hits jobs and income.

There is a long historical pattern where a big fall in transactions precedes wider recessions. When that drops by a lot, say 25 percent year on year, it has historically signaled a recession inside a year or so.

Use turnover ratios as a warning light: when they fall fast, we are moving from boom to bust.

THE US SIGNALS: FLORIDA AND BEYOND

In the US, some states often lead the cycle. When those markets slow, it can be an early sign national activity is turning. And right now, we are seeing Florida crashing.

For example, Florida usually shows the first signs when the U.S. property market is about to go down. A famous case was the Florida land boom in the 1920s. Back then, people could borrow money easily, and ads made it sound like everyone could get rich buying land in the sunshine. People from up north rushed to buy lots without even visiting them. Many sold the land again just weeks later for big paper profits — until the bubble popped and prices crashed.

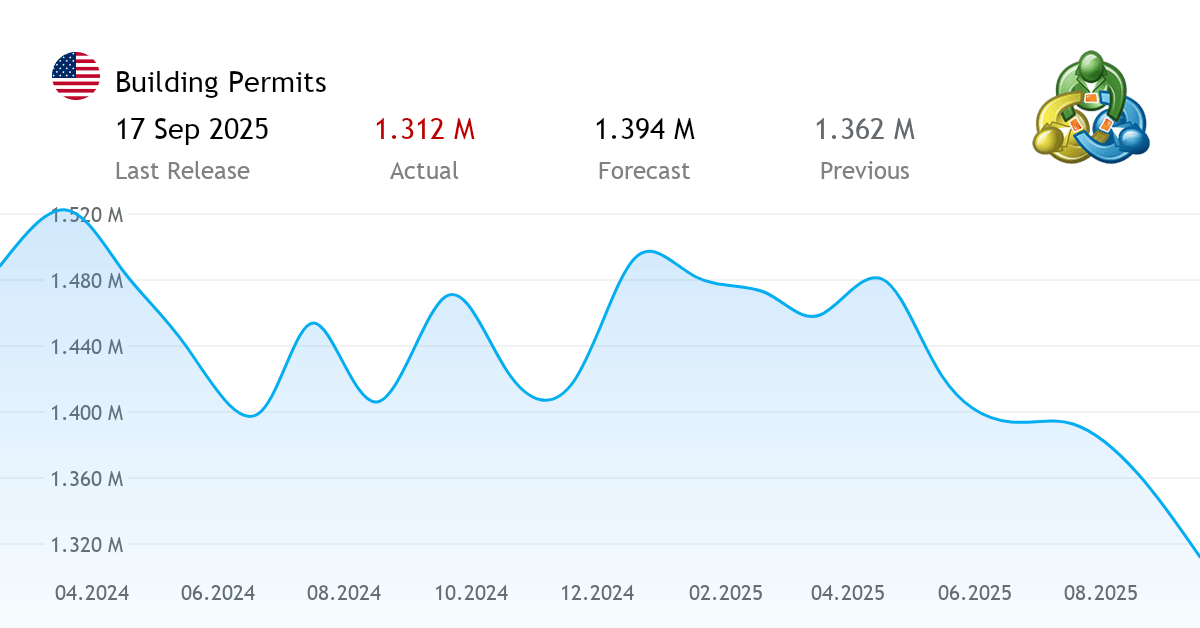

Another indicator, building permits, especially, peak before downturns because builders stop ordering new projects when they see demand fading.

Source: MQL5

Low permits now mean fewer homes will be finished later, but also that builders are cautious, which can presage a broader slowdown.

THE 18.6 YEAR REAL ESTATE CYCLE AND WHY IT MATTERS

Real estate shows long rhythmic patterns. One commonly discussed rhythm is about 18.6 years.

That does not mean a crash every 18.6 years like clockwork, but it helps explain long swings in prices and sentiment.

When you combine short-term policy shocks with a long-term cycle phase that is near a peak, the chance of a sharper correction rises. Right now we appear to be late in a long cycle phase, so adding big demand stimulus can pull up the peak faster and make the correction steeper later on.

WHAT I SEE COMING

Subscribe to Smart X Insider to read the rest.

Become a paying subscriber of Smart X Insider to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- ✅ Ad-free and Exclusive Reports with non-restricted Access

- ✅ Stock & Asset Value Analysis

- ✅ Cycle Positioning Dashboard and Report

- ✅ Early Access to Smart X Capital Platform