TLDR

🚀 High Interest Rates Are Reshaping the Game – With rates still elevated, Buffett shifts to bonds while weak companies struggle under debt.

📈 Markets Are Overvalued, Buffett Is Waiting – While speculation drives stocks higher, Buffett stacks cash, ready to strike when reality hits.

🎰 Speculation Is at an All-Time High – Bitcoin, AI stocks, and retail traders are fueling bubbles—Buffett warns against chasing hype.

💎 Patience and Capital Preservation Win – The real wealth play? Sit tight, hold cash, and deploy when fear replaces greed.

The market in 2025 is set to present unique challenges for investors, but understanding Warren Buffett's perspective can provide us with the necessary wisdom to navigate the financial landscape effectively.

The Challenges Facing Investors in 2025

This year is shaping up to be one of the most interesting in recent memory—mostly because so many people are making irrational investment decisions, presenting us with unique opportunities. But before we talk about capitalizing on those, let’s break down the biggest challenges investors will face in 2025.

High Interest Rates and Their Impact

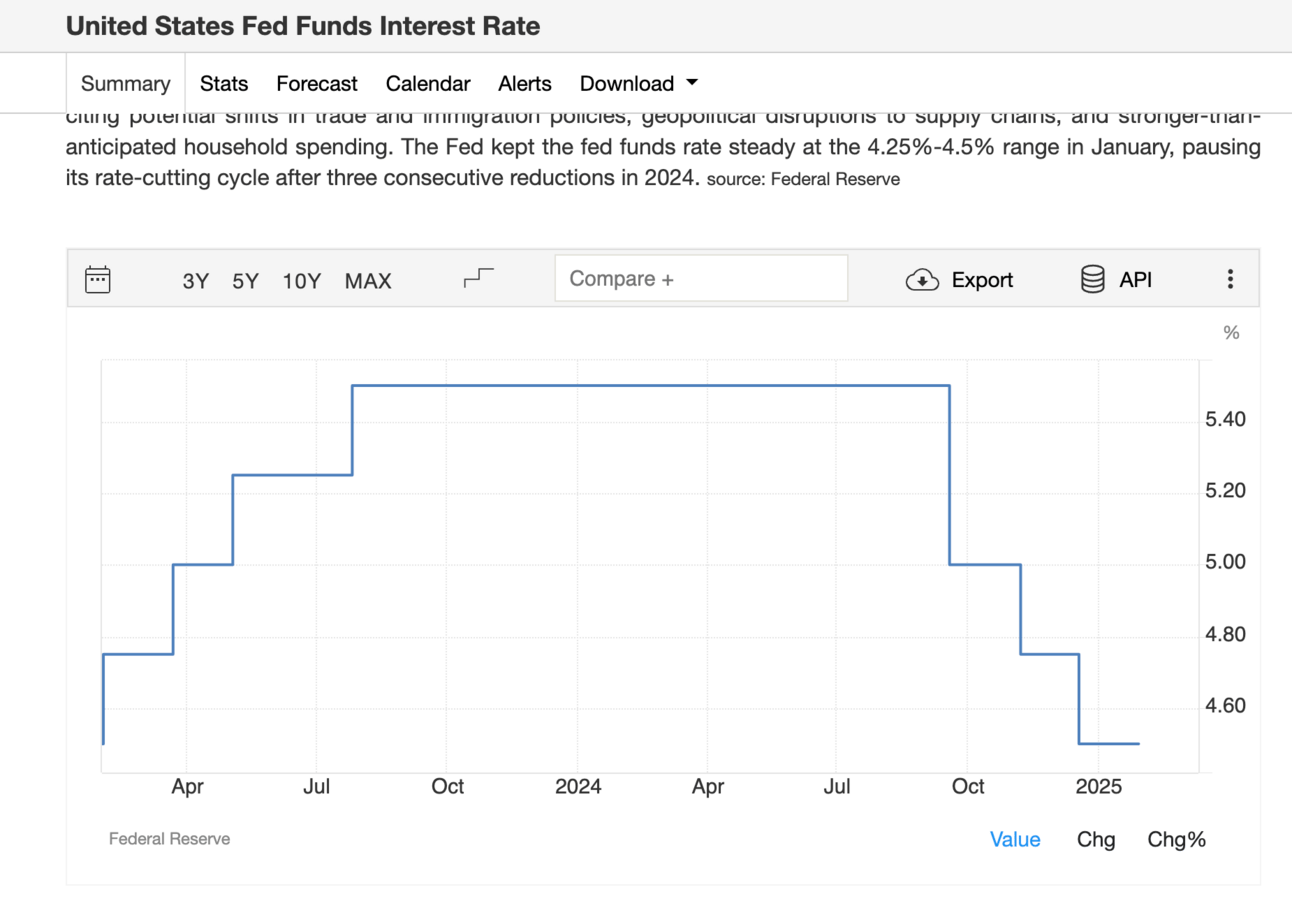

For the first time in decades, investors are dealing with significantly higher interest rates. The Federal Reserve kept rates near zero for years following the Global Financial Crisis, but after inflation surged post-2020, rates shot up. While interest rates have fallen slightly after three rate cuts, sitting now around 4.2%, they remain much higher than they were over the past twenty years.

⏳ Why does this matter?

📉 Higher interest rates increase treasury bond yields, meaning more institutional investors move their money into safer assets rather than stocks.

🚫 Businesses struggle to obtain cheap financing, making expansion and profitability more challenging.

💰 Companies holding a lot of debt experience higher debt service costs, squeezing their earnings.

This brings us to a key concern—if inflation persists due to geopolitical tensions, trade disruptions, global conflicts, or government overspending, the FED may have no choice but to keep rates elevated for a long time. And while many assume high rates should cool stock valuations, last year told a different story, with the S&P 500 rising 23% in 2024 , following a 24% gain in 2023.

Now, how does Warren Buffett deal with this?

Warren Buffett’s Strategy for High Interest Rate Environments

Buffett has always been about risk management , and in today’s world, that means shifting towards bonds while reducing stock exposure.

🏦 Buffett has been selling shares, particularly his massive Apple position, and reallocating funds into short-term U.S. treasuries.

📊 Berkshire Hathaway’s cash position remains stable, but a significant portion has been allocated into higher-yielding treasury bonds to take advantage of the 4-5% returns offered.

🤔 Why bonds? Because they provide a safe risk-free return, especially at a time when stocks appear overvalued while uncertainty looms.

Buffett summed it up perfectly in a shareholder meeting: "We will have what used to produce us 50 million a year now producing around 5 billion a year simply by moving into treasuries." In uncertain times, Buffett safeguards capital, ensuring liquidity is available when real investment opportunities arise.

The Challenge of Stock Market Overvaluation

While rising interest rates traditionally put pressure on stock prices, the modern market has defied expectations.

📈 The S&P 500’s continued growth , despite high rates, can largely be attributed to the Magnificent Seven —Amazon, Apple, Microsoft, Tesla, Google, Meta, and Nvidia. The AI narrative continues to push valuations sky-high, making many stocks too expensive for intelligent long-term investing.

Buffett’s Approach: Waiting for the Right Moment

🛑 Buffett has made it clear —he doesn’t see many attractive long-term investments in today’s market. His cash pile of $168 billion remains largely untouched, waiting for the next downturn.

“You only swing at pitches you like,” he famously said, emphasizing that capital preservation is key when stocks are overvalued .

So what does this mean for us?

💡 Patience is key —the goal isn’t to constantly buy stocks but to wait for clear and obvious opportunities.

🌍 Expand your horizons —Buffett recently invested billions in Japanese trading houses , a market outside of the U.S. where valuations were more reasonable.

🔎 Find undervalued sectors —exploring emerging markets or smaller-cap stocks can sometimes offer hidden gems.

The Rise of Speculation and How to Avoid It

Subscribe to Smart X Insider to read the rest.

Become a paying subscriber of Smart X Insider to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- ✅ Ad-free and Exclusive Reports with non-restricted Access

- ✅ Stock & Asset Value Analysis

- ✅ Cycle Positioning Dashboard and Report

- ✅ Early Access to Smart X Capital Platform