Hey all,

I believe we are at the top of a huge U S housing bubble and you need a simple map of what is happening and what to do next.

I will walk you through the problem in plain words.

I will explain the ugly forces that make housing boom and crash

Why the United States is the global leader?

What makes this moment similar to 2008 and worse?

What you can do if you own assets, want to invest more, or simply keep your money safe?

Why the US matters?

Let me start with something few people truly understand—the United States is the metronome for the entire global economy.

The U.S. controls the world’s reserve currency.

The United States has the biggest financial markets

When land and home prices rise in the US banks lend more, people take on more debt, and the whole world follows that rhythm.

Americans turned real estate into a tradable financial asset earlier and more aggressively than any other country.

That is why watching the US housing market gives the best early warnings for the rest of the world.

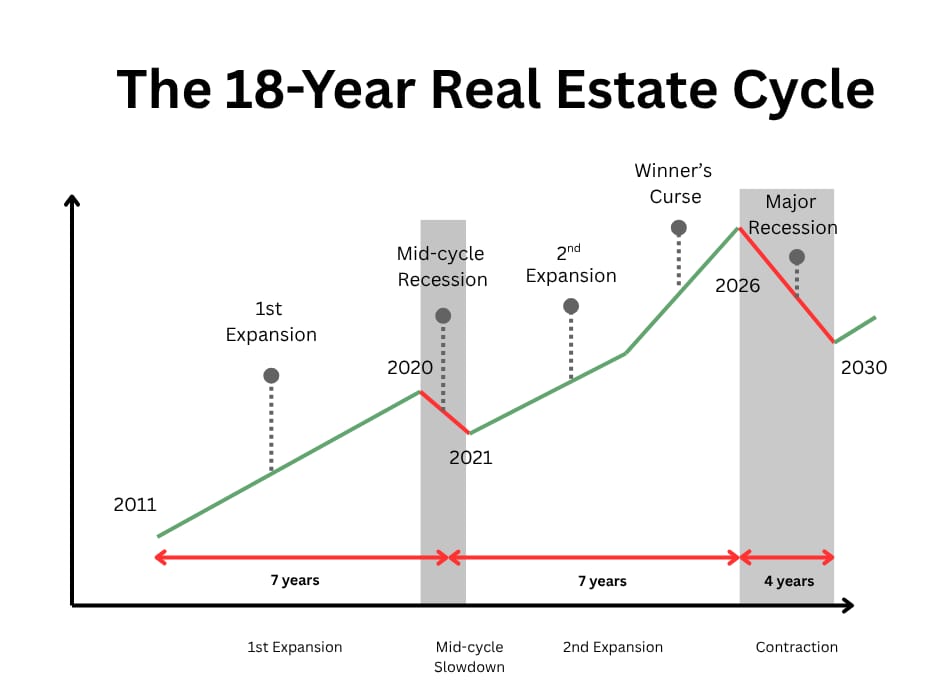

Every major global downturn since the early 1900s has followed an American land peak by one to two years. For example, the years 1926, 1973, and 2006 all followed the same pattern. And now, in the mid-2020s, we stand in that same place again.

The world doesn’t follow because of coordination. It follows because of influence. The U.S. dollar, its debt structure, and its lending machinery shape global credit creation. This rhythm is the 18-year land cycle, the same one that’s been tracked for centuries, and right now we are near the top once again.

Lending fraud is the secret engine of every housing boom

Lending fraud means banks or lending companies create loans and deals that make them rich now while hiding losses that others will pay later. They turn honest institutions into machines that print bad loans and sell the risk to other people or to the public.

Why it matters

Lending fraud makes bubbles bigger and crashes deeper. It shows up as fake paperwork, lied incomes, loans to people who cannot pay, and weird tricks to hide problems. Every major US housing crash had this: the savings and loans crisis the 1980s, the subprime crisis of 2008, and now parts of the mortgage system look like they are doing the same thing again.

In the 1980s criminals bought savings and loan banks and used them to fund risky property deals. They bribed politicians and lied to regulators. The losses became huge and the taxpayer had to pay most of the bill. The lesson was never fully learned.

How the 2008 crisis used the same playbook

Before 2008 lenders made NINJA loans. They let people borrow without proof of income. These loans were bundled into securities and sold to investors with safe labels. When people defaulted the whole web collapsed. The banks got rescued and few executives were punished. That lack of punishment made bad behavior likely to come back.

This cycle in 2025 is using government programs to keep the boom alive

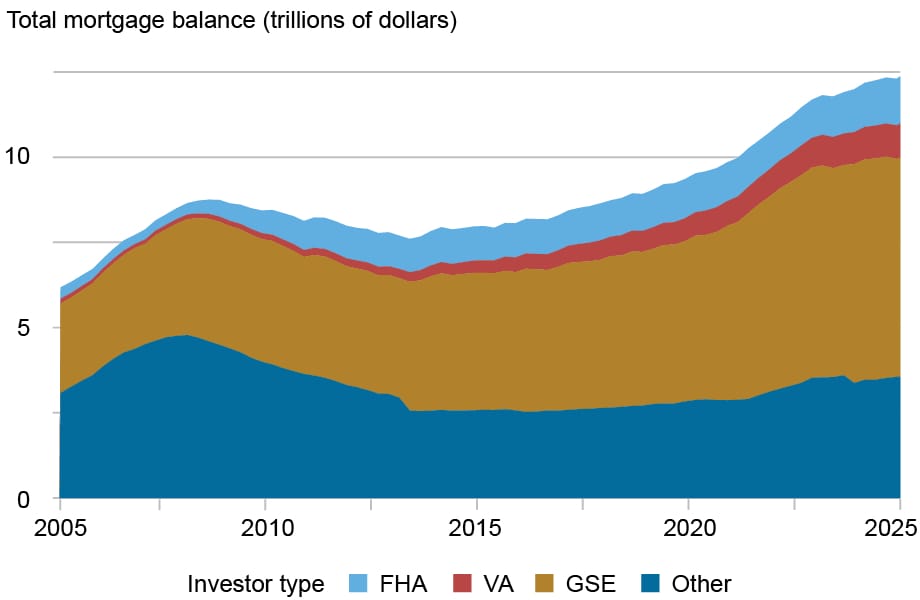

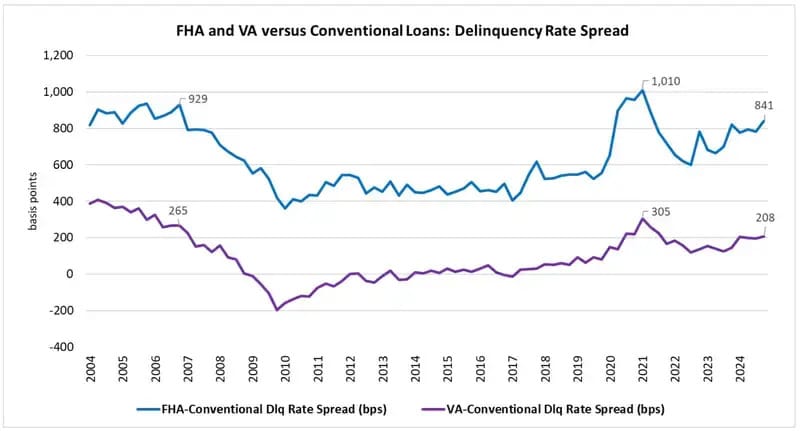

Government backed lending is now doing a lot of the risky work that private subprime lenders used to do. In the US the FHA and mortgage agencies like Fannie and Freddie are doing more low down payment loans and low credit scores. These programs are great when used carefully to help first time buyers. But they can also be used as a modern subprime system if controls are weak.

The share of FHA and similar government lending doubled since the last crisis. That means the government is quietly taking more risk. When a lot of loans fail, the government ends up paying with tax money. That is moral hazard. The same pattern appeared in Australia with big tax and grant programs that pushed more people into buying at the top of the market.

Source: Liberty Street Economics

Vacancy and new builds

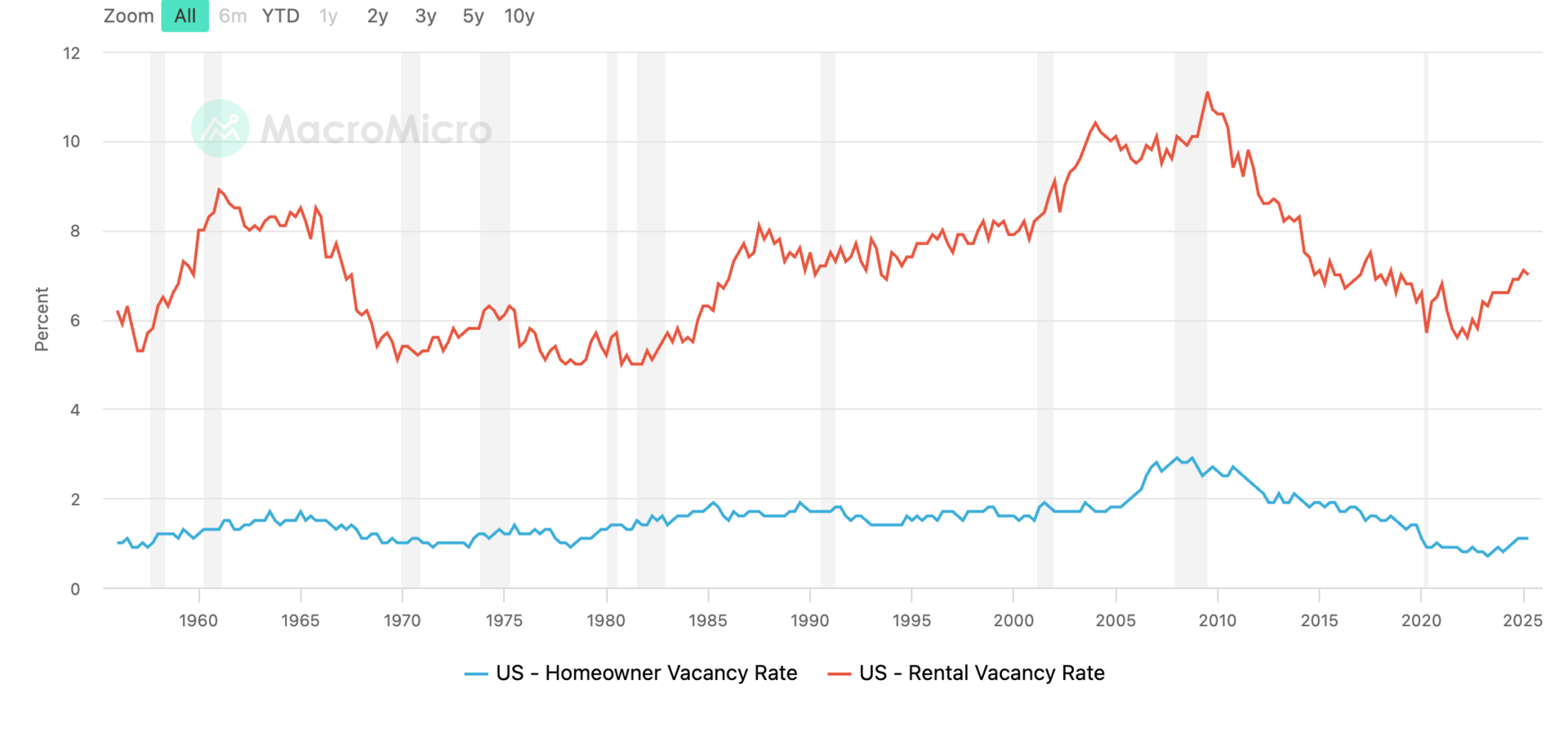

There are millions of vacant homes in the US. New suburbs and cookie cutter houses are empty in places where builders rushed to build. Builders now give big incentives like price cuts, free appliances, and mortgage rate buy downs just to sell. That tells you supply is too high for real demand.

Source: MacroMicro

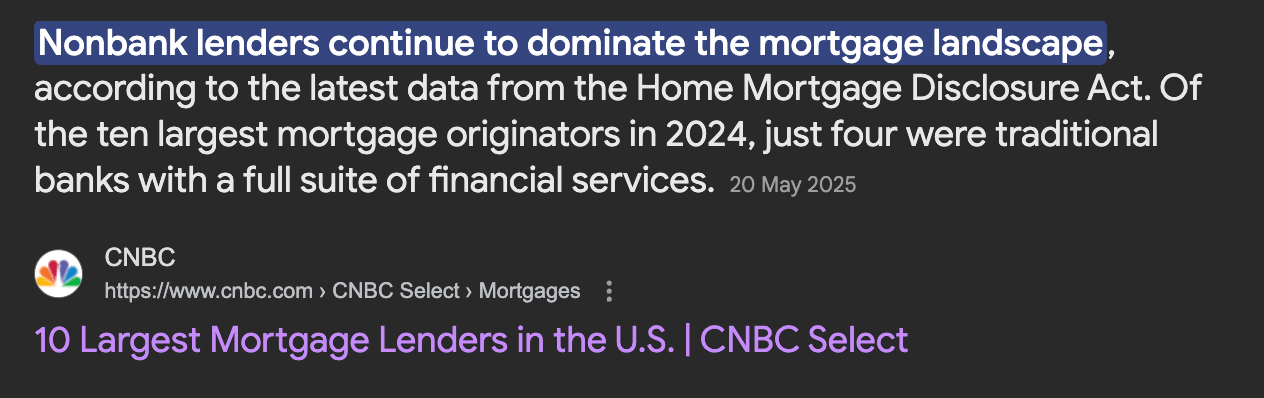

Non banks and hidden delinquency

Big banks are not the whole story. Non bank lenders and servicers now handle most mortgages in the US. They do not report to the same public trackers. That means delinquency and stress can hide for a long time. When private firms start to get liquidity problems the shock moves into the rest of the market.

Early payment defaults and fraud

When loans go bad in the first six to twelve months it is a huge red flag. Early payment defaults often mean the loan was made for the wrong reasons or with lies about occupancy or income. The FHA itself has flagged big early default rates in certain originators. That points to owner occupancy fraud and to loans issued to speculators and investors.

Source: Business Insiders

This cycle may be worse than 2008 for several reasons

Government has already used many tools

Subscribe to Smart X Insider to read the rest.

Become a paying subscriber of Smart X Insider to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- ✅ Ad-free and Exclusive Reports with non-restricted Access

- ✅ Stock & Asset Value Analysis

- ✅ Cycle Positioning Dashboard and Report

- ✅ Early Access to Smart X Capital Platform