Markets move in waves. Property, stocks, commodities, and even technology follow repeating patterns of build up, peak, decline, and recovery. If you can spot where we are in a cycle, you can make smarter choices about when to sell, when to hold, and how to hedge.

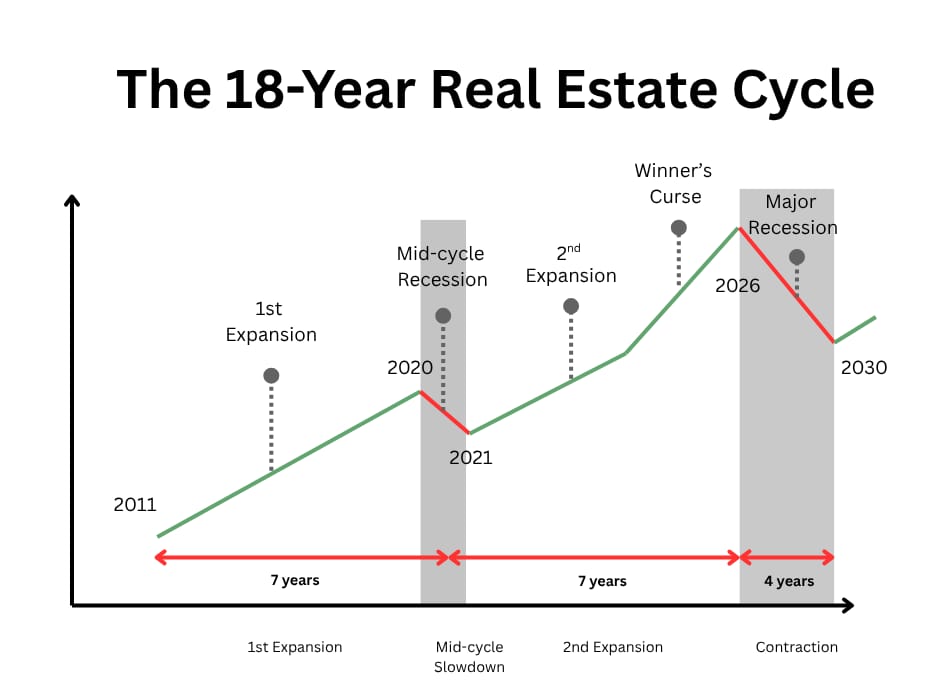

THE 18.6 YEAR REAL ESTATE CYCLE

What it is

This is a long-observed pattern in property markets where big waves of price growth and decline tend to repeat roughly every 18.6 years. Think of it as a long tide that lifts and then drops property values.

Why it matters

When lots of buyers and credit chase limited land and housing supply, prices inflate. That inflation often peaks and is followed by a fall for both the real estate market and stock market. Historically, crashes driven by the property market tend to be a lot more severe, e.g. 2008, 1990, 1929 . Knowing the rough timing helps you plan. If you accept that these waves exist, you can avoid selling too late or get ready to buy when prices are low.

How to use it

I believe we are approaching a peak window in the 2026. That does not mean prices stop rising immediately after the peak, but history shows declines can be sudden and deep when sentiment shifts. If you want to avoid getting caught, think about reducing your position before the cycle peak or having a clear plan to ride the correction.

THE BIG PICTURE: WHAT DRIVES THE PEAKS AND CRASHES

Population and migration

When lots of people move into a place, demand for housing goes up. More demand + limited land = higher prices.

Credit and lending rules

Loose credit and low interest rates make buying easier. That fuels demand and pushes prices up. When lending tightens or rates rise, demand collapses quickly.

Speculation

When many buyers purchase expecting prices to keep rising, bubbles form. The end of a bubble often brings a fast, painful drop.

Commodity cycles and local exceptions

Some places, like regions with heavy mining or energy industries, can buck national trends because a booming commodity market drives local jobs, wages, and housing demand. That can push prices higher even while other parts of the country slow down.

HISTORICAL DOWNTURNS AND WHAT THEY TEACH US

Lessons from past crashes:

The 1890s: Speculative manias in railways and land ended with sharp collapses. After years of rapid growth, both property and equities retraced back to old levels and stayed flat for nearly a decade.

The 1970s: Inflation surged, credit tightened, and housing values stalled across major economies. Stock markets swung violently, and many developers and lenders were wiped out as borrowing costs soared.

The 1990s and early 2000s: The tech bubble showed how sector and regional differences matter. Some cities and industries rebounded quickly, while others took years to recover. In real estate, global credit tightening exposed markets that had relied most on leverage.

2008: Both property and equities suffered together — the land market led the downturn, and the financial system amplified it. Despite massive policy intervention, prices in many areas still fell 30–50%, proving that credit-driven expansions always end the same way.

Two consistent patterns:

Speculation and easy credit multiply the damage.

The most painful crashes follow the easiest money. When leverage replaces productivity, corrections turn into crises.

Recovery depends on real demand, not policy support.

Some regions and sectors recover fast because their fundamentals are strong; others stay weak for years until genuine income growth returns.