TLDR

🚀 Prepare for 2025's crypto bull run : Timing cycles isn't everything—focus on strategy, scarcity, and long-term wealth creation.

💎 Bitcoin halving + ETF approval = explosive potential : History suggests a 7x surge; BlackRock eyes institutional adoption.

🌐 Emerging narratives reshape markets : GameFi, blockchain AI, and real-world tokenization offer high-risk, high-reward opportunities.

🧠 Strategize + exit wisely : Diversify portfolios, scale profits incrementally, and align with Bitcoin's trends for generational gains.

The cryptocurrency market holds promise, risk, and profound potential for wealth creation. But to succeed, fortune must not merely favor the bold—it favors the prepared.

As we step into 2025, the crypto world stands on the precipice of one of its most significant bull runs. This guide will break down the key drivers of this market cycle, strategies to position yourself for success, and how to prepare your portfolio using tried-and-tested methods, all structured to empower you in making informed decisions.

Understanding Crypto Market Cycles

The Rhythm of Bull and Bear Markets Cryptocurrency operates cyclically, oscillating between bull runs and bear markets. Historically, we see recurring patterns:

Bitcoin peaked at $69,000 in November 2021, ushering in one of the most dramatic bear markets in crypto history. Prices plunged 77%, testing investor resolve.

Fast-forward to Q4 2024: Bitcoin has clawed its way back to the $100,000 range, an all-time high

Cycles repeat because human psychology—fear in bear markets and greed in bull markets—rhymes over time. Most notably, crypto's trajectory historically leans toward growth. Since 2009, there have been 10 bull markets compared to just four bear markets. Statistically, investors have a 60% higher chance of navigating a bull market than a bear one.

The big takeaway? Cycles are predictable, but timing them perfectly is nearly impossible. Focus on long-term strategies instead of getting caught up in short-term volatility.

Three Key Drivers of the Crypto Bull Run in 2025

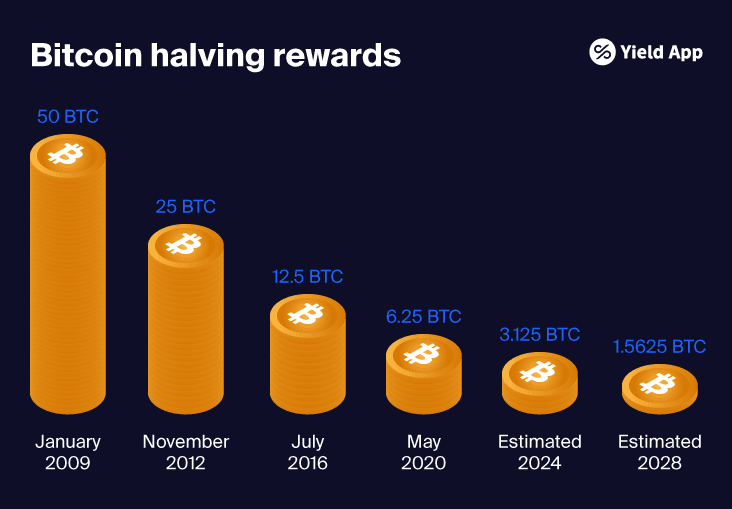

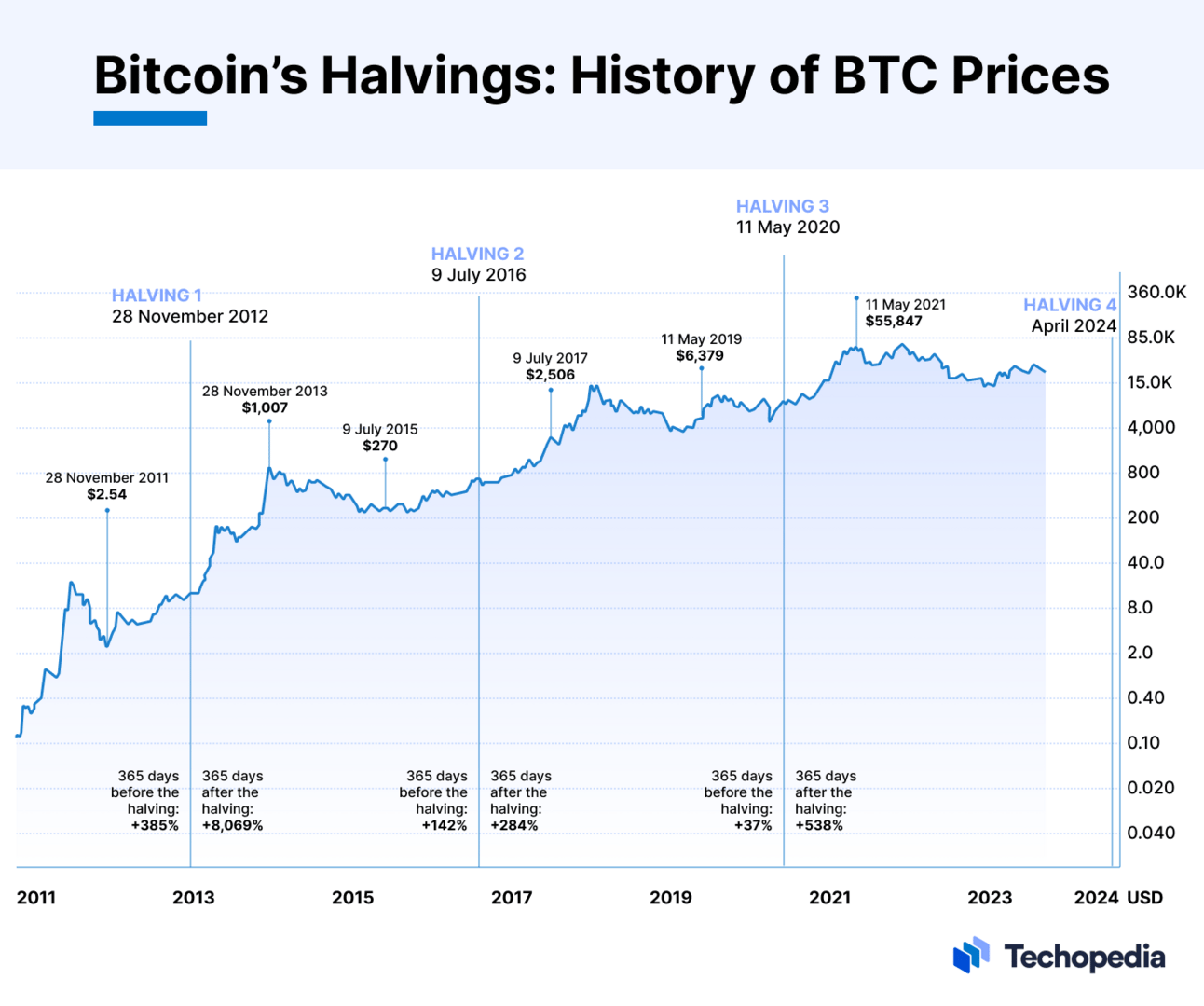

The Bitcoin Halving Narrative Bitcoin halvings have been the cornerstone of every major bull rally. This event, occurring roughly every four years, reduces Bitcoin mining rewards by 50%, creating scarcity and fueling demand.

Here's a look at historic halvings:

2012 : Bitcoin rose from $12 to $1,178—a 9,716% gain.

2016 : It surged from $657 to $20,000—a 2,913% rise.

2020 : Bitcoin hit $69,000 after starting just below $9,000—a 600% increase over 1.5 years.

2024: Bitcoin hit $100,000.

If history rhymes and we see a sevenfold gain post-halving, Bitcoin could test $138,600 in this upcoming cycle.

The Approval of a Bitcoin and Ethereum Spot ETF: The introduction of a Bitcoin Exchange Traded Fund (ETF) is a watershed moment for crypto adoption. Institutional players—those managing trillions of dollars— finally gained seamless exposure to Bitcoin's price action.

Subscribe to Smart X Insider to read the rest.

Become a paying subscriber of Smart X Insider to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- ✅ Ad-free and Exclusive Reports with non-restricted Access

- ✅ Stock & Asset Value Analysis

- ✅ Cycle Positioning Dashboard and Report

- ✅ Early Access to Smart X Capital Platform