Hi all,

I want to lay out what I see coming and exactly how to think, act, and protect what matters.

I’ll keep this simple. Big cycles matter. Land and credit drive everything. When land prices rise, credit grows. When land falls, lending contracts and the whole system shakes. You do not want to be heavily leveraged when the floor drops out.

WHAT I MEAN BY CYCLES

The world moves in patterns. Think of waves. Some are small, some are long. They all stack up and sometimes they match up, making a huge wave.

Land Cycle explained

The land cycle is an 18 yearish wave. People buy land and houses, credit expands, prices rise, more borrowing happens. At the middle and the end of that roughly 18 year span you often see big problems — crashes, big recessions, debt stress. That 18 year rhythm is a core beat under many other cycles.

You might have seen other cycles with similar timings too, such as the Benner’s cycle that goes as far back as 150 years ago. All of these cycles have predicted accurately all crashes that happened, including 1929, 1979, 1999, 2008, 2020, etc. Watch my video here that explains this cycle in more details.

Longer Cycles and why they matter

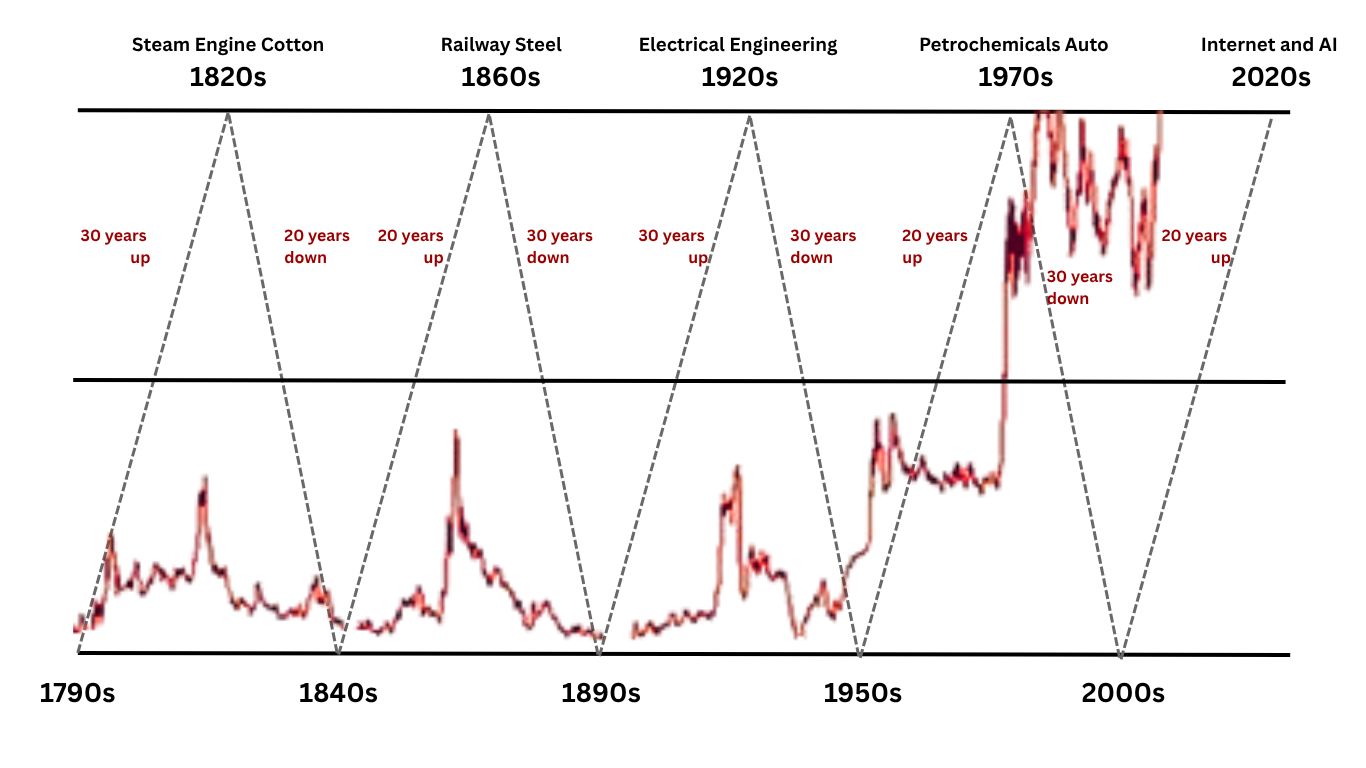

There are longer waves that line up with the land cycle. When they match, the risk is bigger.

🔸 60-year K wave, Commodity cycles show revolution of technology and major and minor upswings and downswings of commodities.

🔸 100-year Gann cycle line up with big social and political shocks like wars and pandemics.

When several of these line up near the same time, the chance of big trouble rises.

WHERE WE ARE NOW

Multiple cycles are lining up into the latter part of the 2020s. That gives a very high probability of a major economic turning point around 2026 to 2028. This is not a crystal ball call. It is pattern recognition. The risk is timing and magnitude, not the direction.

Why 2026 and 2027 are important

🔸 The 18 year land cycle takes us back to the 2007–2008 land and credit crash as a previous cycle point.

🔸 Add 60 and 100 year cycles and you point toward the mid to late 2020s as a cluster of potential turning points.

🔸 History shows that when many harmonics match, market moves and geopolitical stress increase.

MARKETS AND ASSETS TO WATCH

Subscribe to Smart X Insider to read the rest.

Become a paying subscriber of Smart X Insider to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- ✅ Ad-free and Exclusive Reports with non-restricted Access

- ✅ Stock & Asset Value Analysis

- ✅ Cycle Positioning Dashboard and Report

- ✅ Early Access to Smart X Capital Platform