Hey all,

A lot of you asked me about Crypto and if it’s dead so I want to get straight to the point so you know what to watch next. I will explain what pushed bitcoin down late in 2025, how the baking in of credit and money supply matters, what the bitcoin halving rhythm tells us, how this links to the 18.6 year real estate cycle, and what sensible steps you can take now.

LAST YEAR DROP AND HOW I SEE IT

Bitcoin ran up fast into October 2025 and then fell hard. A lot of people lost a big chunk of value in weeks.

There were three main things that pushed big swings in bitcoin:

Leverage and margin calls

When traders borrow money to buy crypto, they get extra gains if price goes up. They also get bigger losses when price goes down. If the price falls, exchanges ask borrowers for more collateral. If the borrower cannot add money, the exchange sells their holdings. This selling can snowball and make the price drop even more.

News and panic

Speculative assets hate scary headlines. Even if the news is only loosely related, traders tie it to crypto and sell fast. Social media and mainstream headlines speed this up.

Liquidity and money supply

When banks and central banks pump out lots of cash or keep money easy to borrow, speculative prices have a softer floor. When that money stops growing or is pulled back, that safety net looks weaker and prices fall more easily.

THE HALVING RHYTHM AND WHAT IT TELLS US

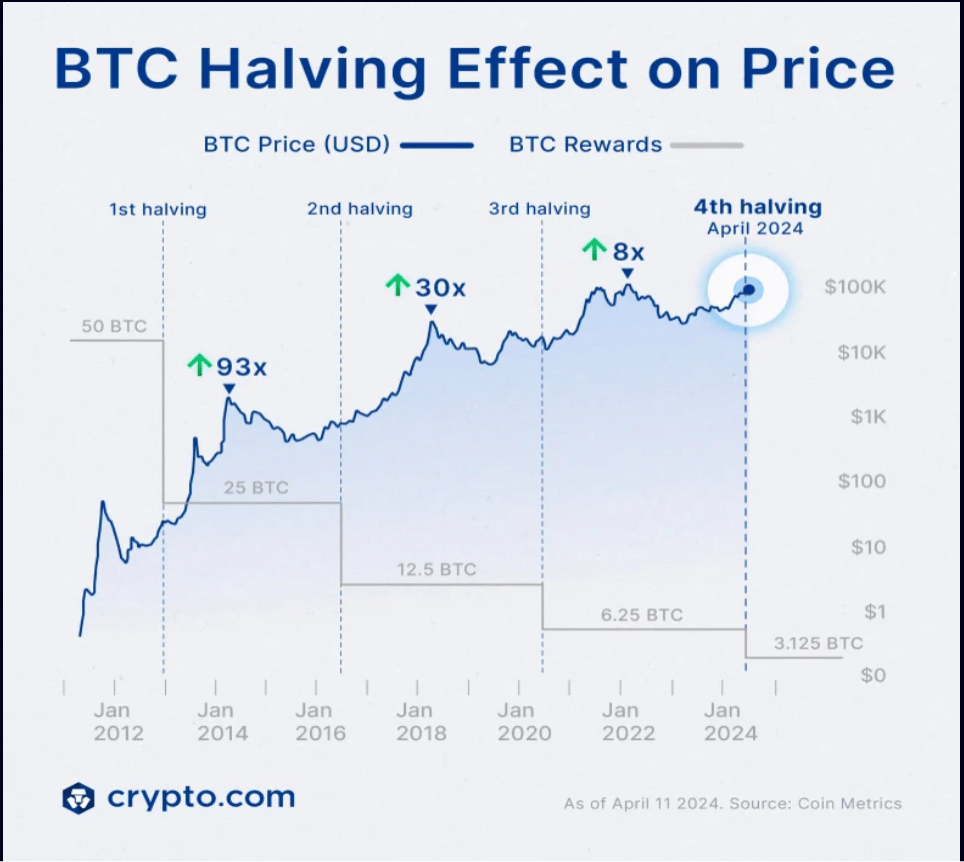

For those who don’t know, Bitcoin mining is how new coins are made and transactions are checked. Every roughly four years, the reward miners get for finding a block is cut in half. That is called the halving. Fewer new coins hit the market after each halving.

What usually happens after a halving?

Historically, bitcoin prices tend to enter big runs in the years after a halving. The pattern we have seen is price climbs, peaks, pulls back, and then another bigger climb in the next cycle. The gains have been smaller each time but still large.

What the recent halving did

There was a halving in April 2024. After that, price rose a lot of around 80% from $58k and hit a high in October 2025 of $122k. Then the correction happened. The timing looks similar to past cycles where we see a peak around the middle of the period between halvings.

What this means for future timing

If this pattern keeps repeating, the next halving will be in 2028. Big moves often cluster around these cycle points. But cycle is not a rule. It is a pattern you watch, not a magnet that forces behavior.

Interestingly, this might coincide or be near with the reliable 18 year real estate cycle bottom when the next cycle hits. I talk a lot on this cycle and how it predicted accurately all crashes in the last 200 years (1929, 1999, 2008, 2020, etc) so if you want to know more about it, check it out here: https://newsletter.smartxcapital.com/p/property-cycle-predicts-stock-market-peak-by-2026

Real Estate Cycle

HOW MONEY SUPPLY CHANGED EVERYTHING

Prices of speculative assets like bitcoin rise when central banks are printing or easing credit. That extra liquidity finds its way into bets, including crypto. When M2 or global liquidity stops growing, the upward support fades.

The global money supply flattened in 2025. This took away a lot of fuel for speculative buying. Bitcoin became more sensitive to any sign that liquidity was shrinking. Combine that with leverage and headlines and the result was a steep fall.

If central banks ease again and money supply starts to climb, crypto could get another boost. If they tighten, bulls will struggle and volatility will stay high.

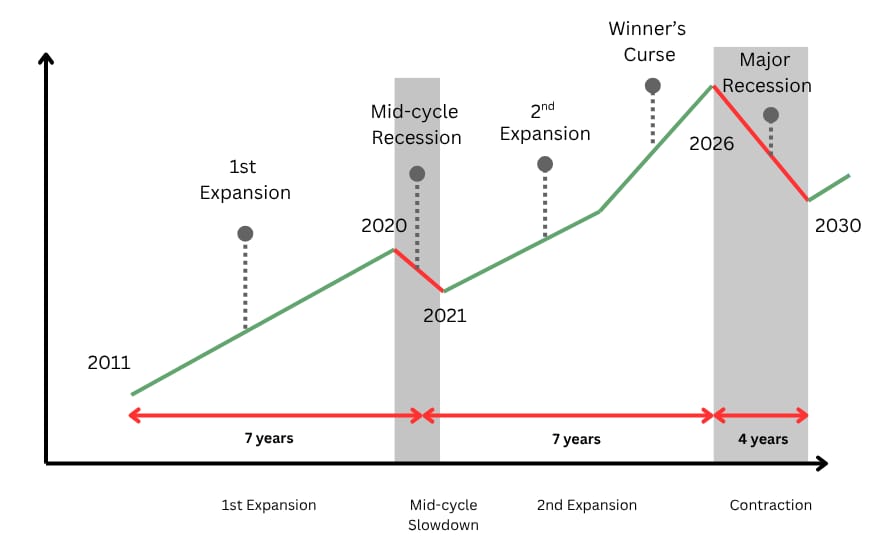

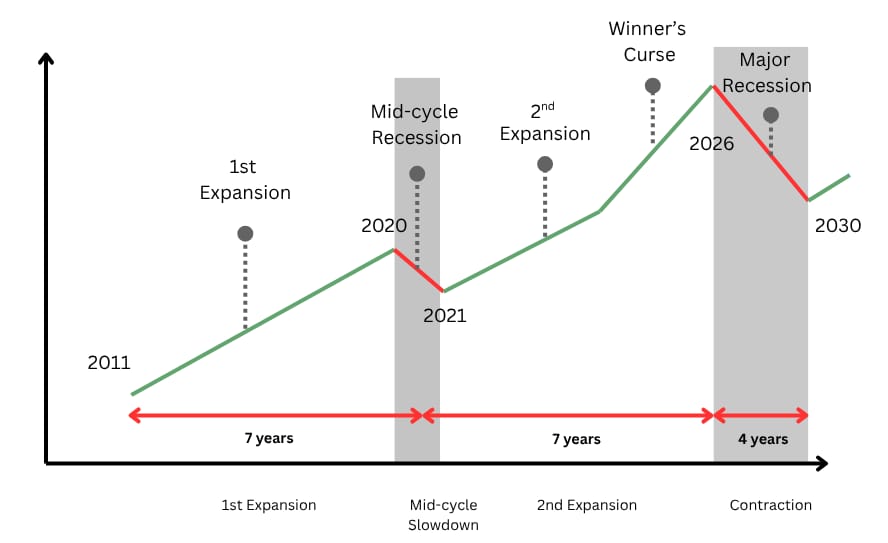

HOW THE 18.6 YEAR REAL ESTATE CYCLE FITS IN

Real estate cycles are long. One repeated pattern is roughly 18 and a half years from trough to trough. These cycles carry big credit booms and busts and predicted accurately all crashes in the last 200 years (1929, 1999, 2008, 2020, etc). When land and property are at extreme high and low levels, the wider financial system often gets stressed.

Real Estate Cycle

Why this cycle matters for crypto and stocks

When credit expands strong enough to push real estate up a lot, more money chases everything risky. Crypto booms can happen in that phase. When the real estate cycle turns and credit starts to pull back, speculative assets often tumble.

Where we sit now

We are in the later phase of the current 18.6 year cycle, the Winner’s Curse phase. That phase is when speculation is loudest and corrections/crashes can be sharp. If history repeats, by the time we reach the next halving in 2028, the real estate cycle could be in a downturn or recession phase. That matters a lot for liquidity and for high risk assets.

WHAT I THINK COULD HAPPEN NEXT

Subscribe to Smart X Insider to read the rest.

Become a paying subscriber of Smart X Insider to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- ✅ Ad-free and Exclusive Reports with non-restricted Access

- ✅ Stock & Asset Value Analysis

- ✅ Cycle Positioning Dashboard and Report

- ✅ Early Access to Smart X Capital Platform