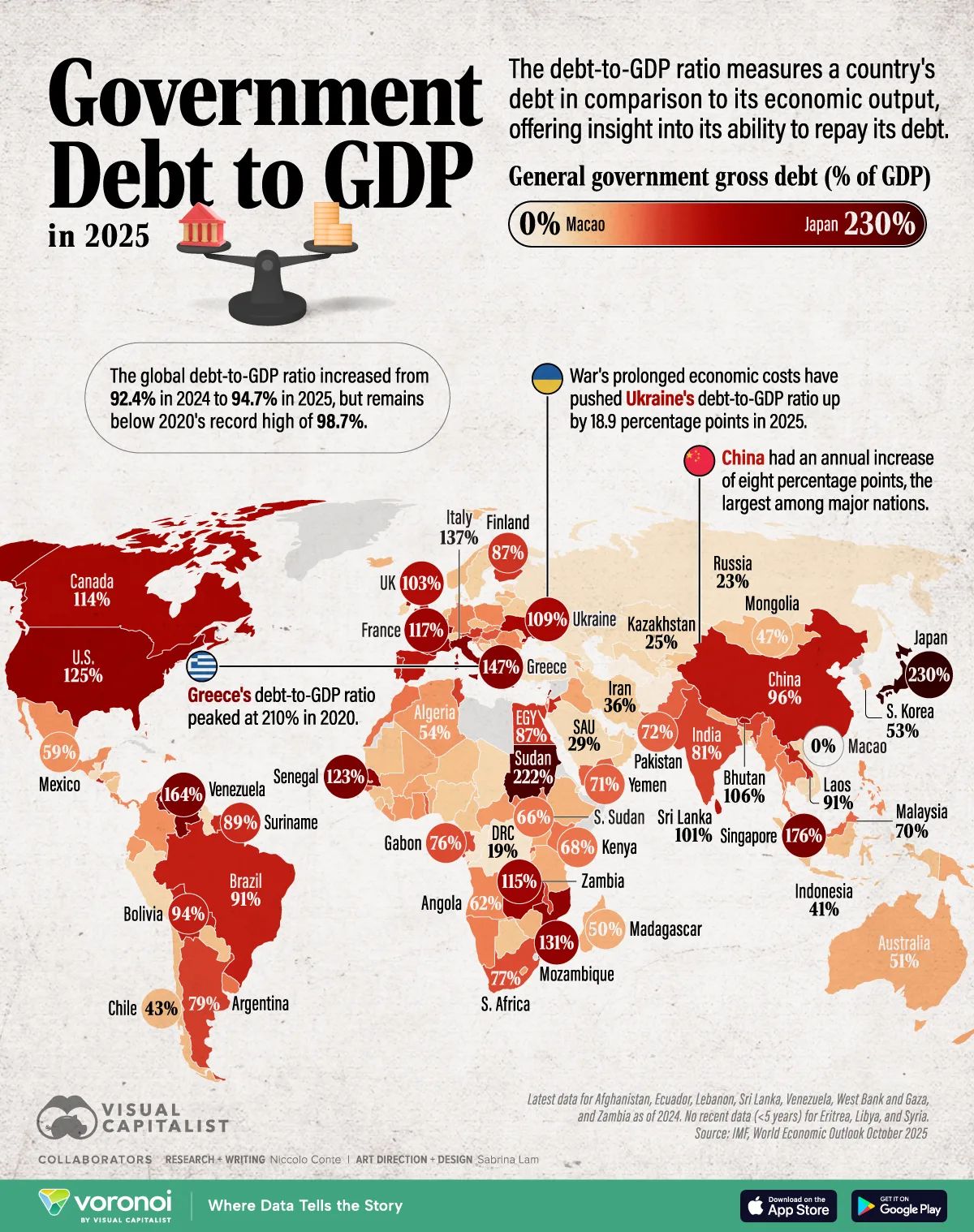

I was reviewing the book the Big Debt Crisis the other day and realised the severity of the US’ debt level and the same goes for most other countries in the world. However, one question did come to my mind. If all of these countries are all indebted to each other, who’s the net lender?

So I did a bit of digging and prepared this newsletter for you all. This piece should contain info on where national debt comes from, who lends the money, why governments don’t usually pay it all back, what the big risks are, and how this ties into real estate cycles and investing in stocks. By the end, this should give one a clear guide on how to think, plan, and take small steps to protect one’s money.

Why I care and why you should too

I care because this affects jobs, schools, health care, home prices, interest rates, pensions, and the money in your pocket. When countries borrow too much, it can make life harder for almost everyone. I want you to feel less confused and more in control. Understanding this stuff helps you make smarter money choices.

What is national (sovereign) debt?

Governments spend money on things like roads, schools, military, and help when disasters happen. When they spend more than they collect in taxes, they borrow money. The total amount they owe is called national or sovereign debt.

This debt is like an IOU. It comes in many forms, often as government bonds that promise to pay back interest and later return the amount borrowed (the principal).