I guess you can see right now of the bubble we are in. We have both: a huge surge in AI and big tech stocks, and a real risk where geopolitics — especially anything that affects Taiwan — could change the whole tech supply chain overnight. That combination makes markets fragile. If you own property, stocks, or crypto, you should know how these forces connect and what to do.

QUICK NEWS I’M WATCHING

🟠 China’s military shows training grounds around Taiwan’s capital — that’s a real sign of risk to Taiwan and global tech supply chains.

🟠 AI has driven big tech valuations higher; many firms rely on Taiwan for advanced chips given TSMC, the main chip manufacturer in the world is in Taiwan.

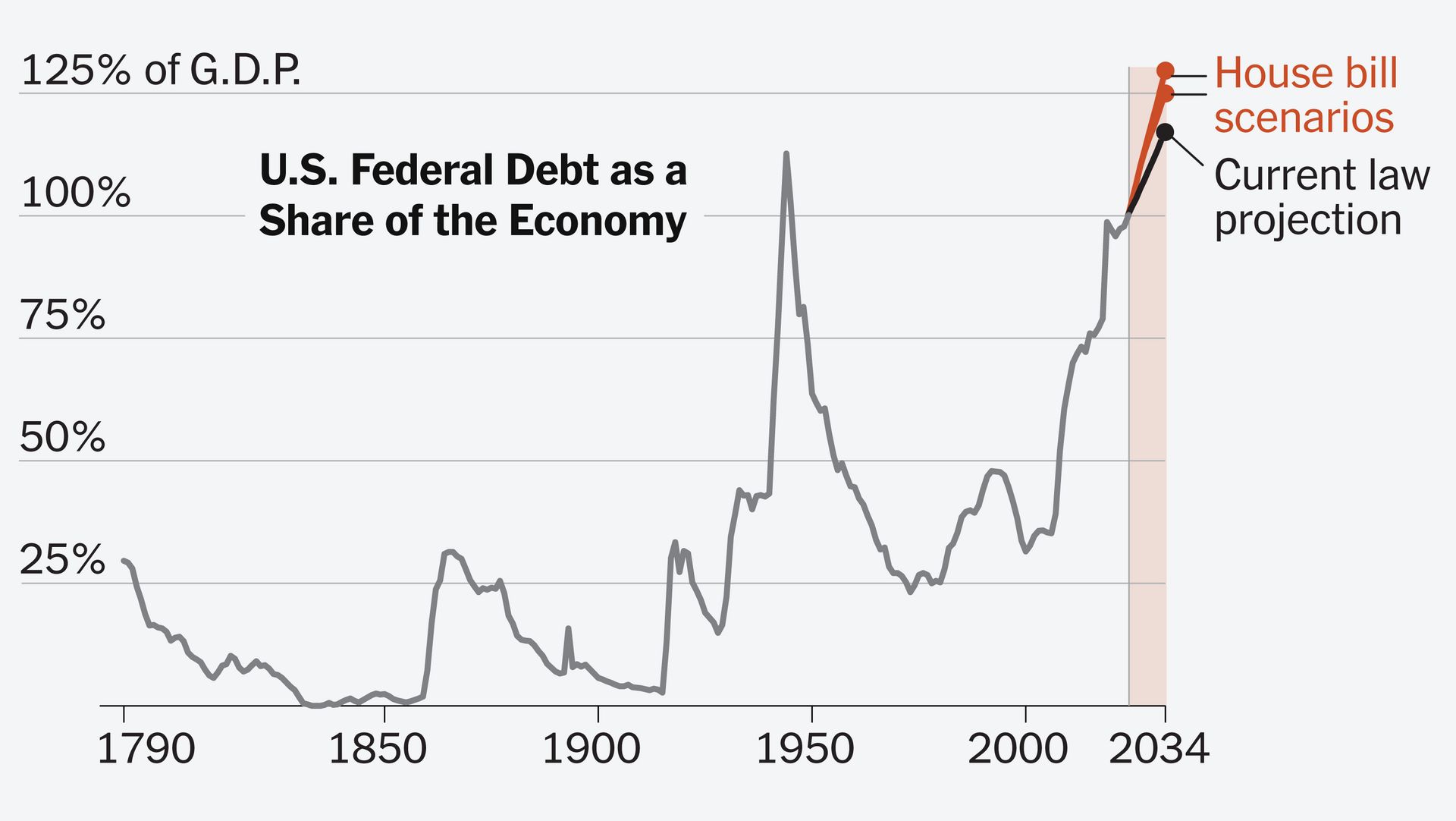

🟠 Current Big Debt levels and credit flows still matter. Big expansions of credit often lead to the expensive top of property cycles.

Source: New York Times

THE BIG PICTURE

The big picture I’m seeing is this. In every cycle bull run and peak like we have now, banks and lenders make borrowing easy which prop up prices for assets — especially land and houses.

The 18 Year Real Estate Cycle

And at the same time, as rates get lower and lower, people start to search for yield and they start to take on riskier investments like stocks, real estate, and crypto. New tech (like AI) becomes the perfect investment since the return is insanely high, companies are all blue chips. And as always, this investment is only focused toward a few big companies because of their economies of scale and unfair advantage. That concentration makes markets more fragile.

With such concentration, every nation wants a piece of it. And that piece is now concentrated in Taiwan, the capital of AI chip semiconductors. That’s why right now, wars, blockades, or even threats around places like Taiwan can break supply chains and sequentially the whole global stock market.

THE 18.6-YEAR CYCLE (WHAT I WANT YOU TO KNOW)

I keep coming back to this important idea from history because it underpins every single thing you’re seeing right now. In my reading and study of cycles, one thing that I know for sure is that CYCLES ALWAYS REPEAT. And if you’ve been reading my newsletter for a while, you would be very familiar with this. The cycle I’m talking about is the Real Estate cycle, and it on average repeats every 18.6 years.

Right now, we are in the Winner’s Curse phase, right near the peak, and every signs the cycle mentions is showing right now. Geopolitical issues, wars, overconfidence in the stock market, highest ever debt level, ridiculous valuation and speculation, high level of commodity prices, etc…

Now Taiwan matters because it makes most of the advanced chips we use. If Taiwan were blocked or attacked, chips stop shipping, factories stop, and tech earnings will drop. That affects stock prices and can push economies into recession.

For property, a sudden economic slowdown can lead to job losses and lower housing demand — especially in places highly exposed to tech sectors. And we all know, once the housing market crashes, everyone suffers, from the rich to the poor (since a home is something most social classes have). Not only that, given how our retirement funds are all in the stock market right now and how passive investing has been an time high trend, the collapse can be worse that we can imagine.

PORTFOLIO ACTIONS I’M TAKING

🟠 Reduce concentrated tech exposure: Sell partial stakes in very expensive, over-weighted tech names if they make up a large share of your portfolio.

🟠 Increase diversification: Add exposure to energy, commodities, and defence-related equities that tend to do okay when geopolitical risk rises. Though I am aware we are near the peak of the commodity cycle too, so I have my own strategies around that right now.

🟠 Trim leverage in property positions: Aim to reduce mortgage stress and increase cash buffers so I can survive a downturn.

🟠 Keep a cash buffer: 6–12 months of living costs depending on job security. Plus keeping majority of my portfolio in cash in different banks, countries and currencies. Cash gives flexibility.

Thank you for reading. I’ll keep watching the mix of AI hype, real estate cycles, and geopolitical risk — especially anything that affects Taiwan and semiconductor supply — and I’ll share what I learn. If you want, tell me which part of this you want me to expand on next time: real estate timing, a step-by-step stock screen, or a deeper scenario plan for geopolitical shocks.

We also have have other similar articles on our website too.

Tools I use

Sharing with you the tools I’m using at the moment.

Value Cycle Stock Investing Checklist v2026

This is the exact stock screening system I use to narrow thousands of companies down to just a few high-quality, high-conviction investments, growing my portfolio to $400k in 5 years.

Coinbase Crypto Platform - Coinbase

📝 $5 When Join to Track investments, all assets and debt - WeMoney

📊 $15 OFF - TradingView (Charting Tool)

🧾 Crypto tax reports - Koinly

📈 33% OFF Track your investment performance and taxes - Sharesight

📚 Books I read: https://linktr.ee/smartxcapital

🧭 Why I’m Building the Smart X Capital Platform

I’m building something for investors who want to move smarter — not faster.

This isn’t for everyone. It’s for those who want to understand wealth through time, not tactics

A place where we’ll track these cycles together, share real-time insights, and learn how to invest with the cycle — not against it. I’ll be offering workshops, tutorials, and in-depth guides to help you build a timeless investing system that grows through every boom and bust.

📚 The Smart X Capital Platform is coming soon — a place to learn, connect, and stay ahead of every major market cycle using data, history, discipline and our community.

🚀 Be First to Join

If you’ve been following my emails and you want to be ready for 2026, now’s your moment.

Because when every major cycle converges — the prepared don’t panic. They profit.

Talk soon,

Ace — Smart X Capital’s Founder

Disclaimer: The information shared in this newsletter is for educational and informational purposes only. It is not financial advice, investment advice, or a recommendation to buy or sell any security or asset. Always do your own research or consult a licensed financial professional before making investment decisions.