I treat gold like a special kind of money, one that people around the world have trusted for thousands of years. It is different from your bank balance or a promise on a piece of paper because it does not depend on anyone else to make it worth something. That makes it useful when systems get shaky.

HOW MONEY HAS WORKED THROUGH HISTORY

Hard money versus promises

Hard money is money tied to a limited physical thing, like gold or silver. Promised money is the kind you see today, where paper or digital balances are not connected to anything real and can be increased by banks or governments.

Two paths when promises fail

When governments promise their money is backed by a hard thing and then face too much debt, they face two painful choices

🟡 Stick to the promise and cause big economic pain and defaults

🟡 Break the promise, create more money, and cause inflation

Both choices reset things but in different ways.

One destroys debts through deflation and hardship.

The other reduces debts by inflating them away and raising prices.

WHY GOLD STANDS OUT

Long track record

Gold has been used across cultures and centuries. That long history means people instinctively trust it in times of trouble.

Hard to take or erase

Gold is physical. You can hide it, hold it in a safe, or store it abroad. It cannot be hacked. It cannot be erased with a ledger entry. That makes it harder for governments or bad actors to steal through clever accounting or cyberattacks.

Keeps value better when systems break

When governments create too much money or impose emergency taxes, gold tends not to fall like paper money does. It acts like a lifeboat when the main ship is leaking.

GOLD AND MODERN FIAT MONEY

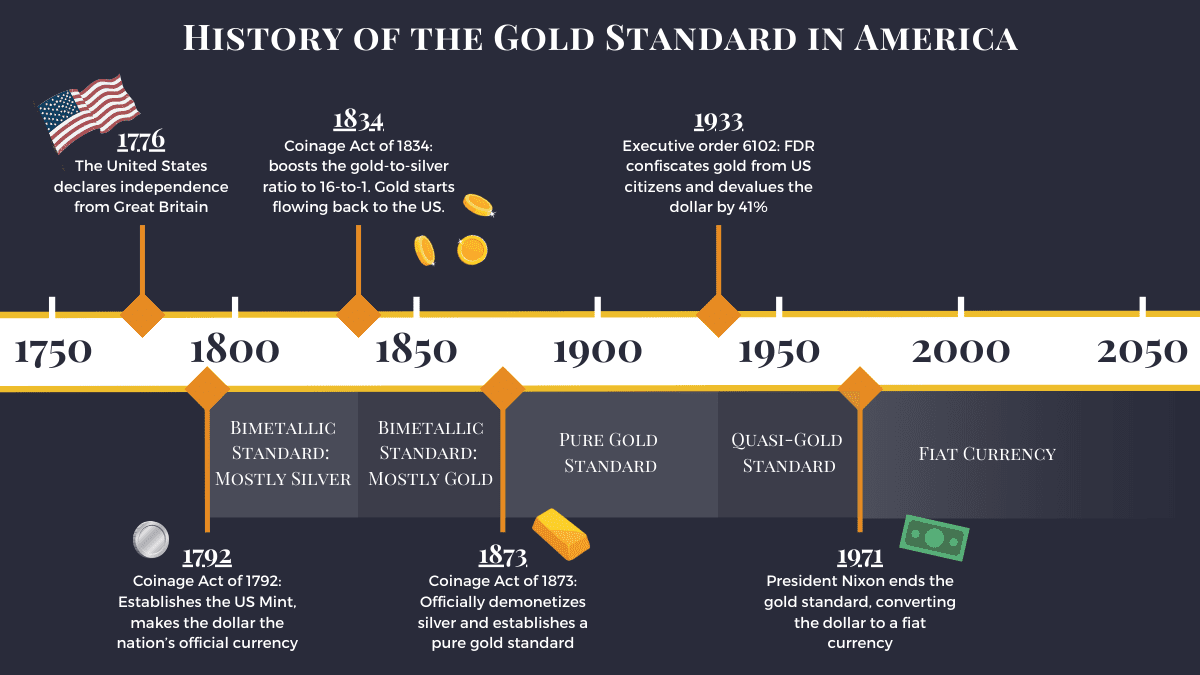

Since the early 1970s most big currencies are not tied to gold. That means governments and central banks can create money without a direct natural limit. That gives them power to fight crises but also risks bigger inflation over time if they overuse that power.

When debts are large and the incentive to print money grows, gold usually does well compared to paper money. It is not guaranteed to rise every year, but it tends to protect purchasing power over long periods.

HOW I THINK ABOUT GOLD IN A PORTFOLIO

Think of gold the way you think of cash

Gold is a form of nonproductive money. It does not earn interest like a bond or dividends like a stock. So you should treat it like a safety asset that preserves value when other things fail. I treat gold the way I treat cash in my strategic plan.

Strategic allocation first, timing second

Start by deciding how much gold should live in your long term mix. That is strategic and should be based on your goals, other assets, and how calm or worried you are about big money system problems.

Tactical adjustments are for the few

Only change your strategic mix for short term reasons if you truly understand market timing and accept the risk. Most people are better off sticking to the plan.

More on timing later in this newsletter.

A practical range

In my view a reasonable baseline for many investors is to hold some gold somewhere between five percent and fifteen percent of total assets. Where you land inside that range depends on your other holdings and how safe you want to be.

WHEN TO OVERWEIGHT GOLD

Subscribe to Smart X Insider to read the rest.

Become a paying subscriber of Smart X Insider to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- ✅ Ad-free and Exclusive Reports with non-restricted Access

- ✅ Stock & Asset Value Analysis

- ✅ Cycle Positioning Dashboard and Report

- ✅ Early Access to Smart X Capital Platform