TLDR

🚨 We’re exiting empire peak, entering decline—debt, inflation, and division signal the next global power shift.

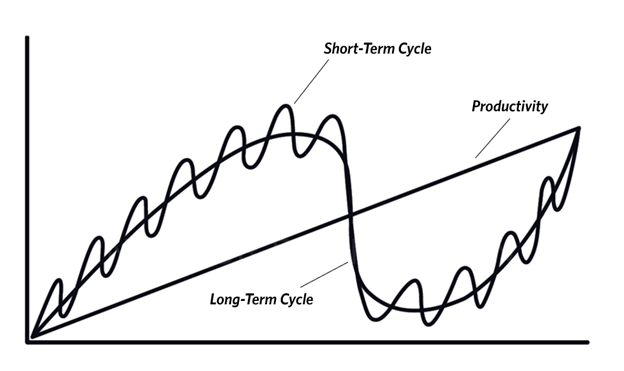

🧠 History doesn’t repeat—it sings in cycles. Study them to unlock timing, positioning, and asymmetric advantage.

💰 Cash is trash in decline. Convert to assets that hold value

🌍 Sovereignty is the new wealth—diversify income, skills, and geography before the system reshuffles the board.

The Reality of Big Cycles

We are not where we think we are — we're in the middle of a historic transition, and most of us are asleep at the wheel.

Over the years, I’ve realized the world works in patterns. Civilizations, economies, and empires all rise, peak, decline, and collapse—over and over again. These are what Ray Dalio calls “The Big Cycles,” and whether you like it or not, we’re deep into one now.

What surprises people the most about cycles is how obvious they are—after the fact. And that's exactly the point. Most are caught off guard because they're focused on the present. But in order to anticipate the future, you must look to the past. That’s how serious investors, power players, and nations navigate downturns and position themselves during the chaos.

Let me show you how it works.

What is a “World Order” and Why It Matters

A world order is the established structure of governance, finance, and power both within a country and globally. These orders determine how nations interact and compete. But here's the key—these systems are fragile, and they change violently when the balance tips.

Internally, empires have constitutions and laws. Globally, treaties and agreements set the rules between powers. But none of these are permanent. They function only so long as the dominant empire can enforce or inspire respect. Once that strength weakens—through debt, overextension, or internal division—the order breaks.

The 3 Forces Driving Our Current Shift

Ray Dalio breaks it down into three key forces that fuel the transition from one world order to the next—and all three are happening right now:

🔥 Not Enough Money: Governments are drowning in debt. Central banks are forced to print money rather than tighten. This happened in 1971 under Nixon and again in 2008 and 2020. Every instance devalues currency, causes inflation, and floods capital into hard assets like stocks, gold, and real estate.

🧨 Internal Conflict: Rich vs poor. Left vs right. The wealth gap fuels anger and extremism. Political systems degenerate into polarization, populism, and eventually chaos.

⚔️ External Conflict: A rising power (China) challenges an established empire (United States). History shows this almost always leads to war. Empires do not decline peacefully.

Subscribe to Smart X Insider to read the rest.

Become a paying subscriber of Smart X Insider to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- ✅ Ad-free and Exclusive Reports with non-restricted Access

- ✅ Stock & Asset Value Analysis

- ✅ Cycle Positioning Dashboard and Report

- ✅ Early Access to Smart X Capital Platform