Hi all,

I first learned about a long running market pattern that people have watched for more than 150 years which has helped me make over $400k in my early 20s, and I want to explain how it works in plain words and how you can use it. I will also show simple checks you can do on your own and how I mix this pattern with other checks so I am not caught by surprise

WHAT IS THIS 150 YEAR OLD MARKET PATTERN

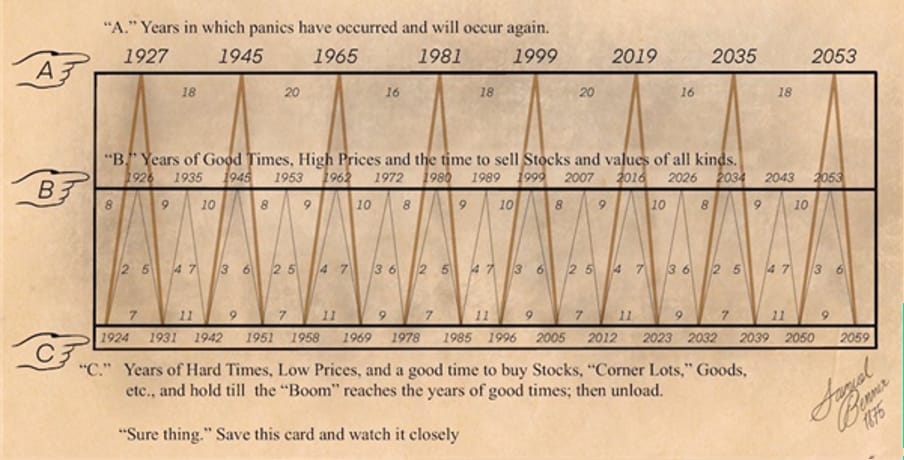

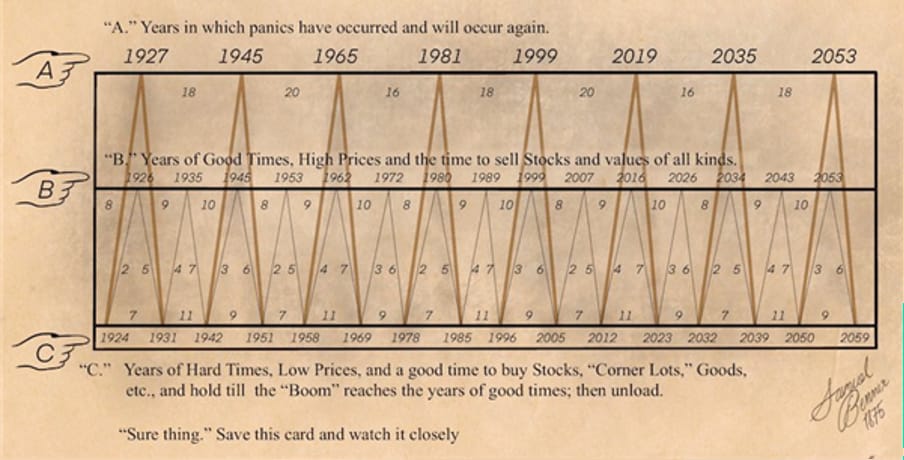

What I call the old pattern is a cycle idea that was made by a market watcher in the late eighteen hundreds called Samuel Benner. He believed prices and events repeat in time and that you could draw a repeating curve that lines up with many big booms and big drops over many years like 1929, 1989, 1999, 2008 and 2020. People have compared that old curve to real history and found it lines up with many big market tops and bottoms through the last one hundred and fifty years.

The curve shows years when things are very hot and risky and years when things are cheap and good to buy.

The curve has three levels:

The top level shows the worst crashes and big panics

The middle level shows milder price peaks where you might sell to lock gains

The bottom level shows times when prices are low and a good time to buy

HOW IT WOULD HELP A LONG TERM INVESTOR

If you could follow the curve roughly you would sell around the hot times and hold cash or safer things. Then when the curve goes low you buy back in and hold until the next high. If done well this simple idea could turn a much better long term return than staying fully invested the whole time. But it is not a magic map and it has limits.

First this pattern is rarely exact It can be off by a year or two so you have to allow wiggle room.

Second many people never hear of the pattern so it does not make everyone rich

Third markets change with new rules, wars, new products, and new money so a pattern from a long time ago can be helpful but not perfect

If a cycle says a peak is coming in 18 months, I start slowly trimming risk. I will move some money to safer things like bonds or cash. I also write down target entry prices for when the market falls so I know where I will add back later. The key is to move slowly not to guess a single top.

OTHER CHECKS I ALWAYS USE WITH THE PATTERN

I never use the old pattern alone I combine it with simple checks that are modern and track the economy These checks help me avoid being too early or too late

SHILLER PRICE TO EARNINGS RATIO EXPLAINED

This is the cyclically adjusted price-to-earnings ratio which is a stock valuation measure usually applied to the US S&P 500 equity market. It is defined as price divided by the average of ten years of earnings, adjusted for inflation.

When this ratio is very high it means people are paying a lot for each dollar of profit. That can signal extra risk If it gets up to extreme levels I start taking risk off the table When it falls a lot I start buying again.

If the ratio is close to its old highs I slow my buying and start selling. If it is low I add slowly over time.

And right now, we are at the old Internet Bubble level, and highest ever. So you do what you would with that.

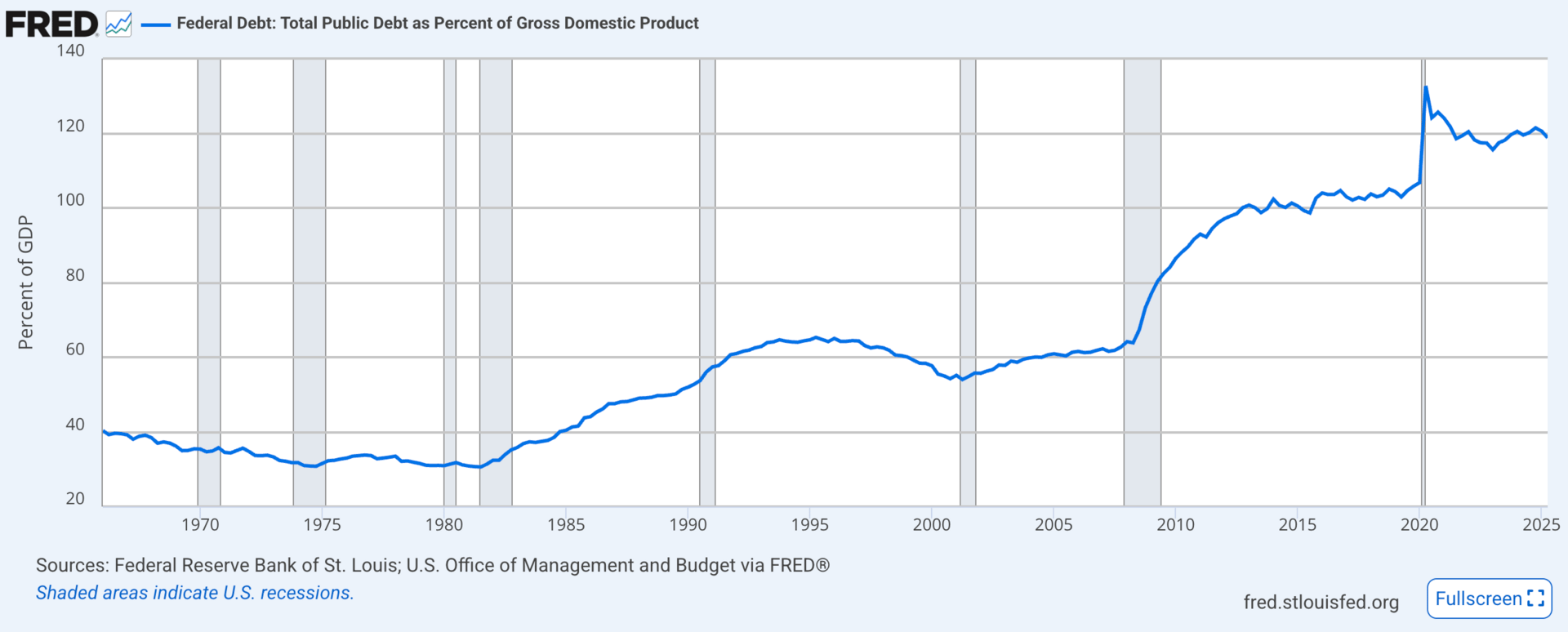

TOTAL DEBT TO GDP

This tells me how much debt a country has compared to how big its economy is. In plain words how many dollars we owe compared to how many dollars we make each year.

A very high number means the country and people are very borrowed If many people are borrowed a small shock can cause big problems It is smart to be extra careful when debt is high.

When a country gets close to very high debt I look to trim risk and keep a bigger cash buffer

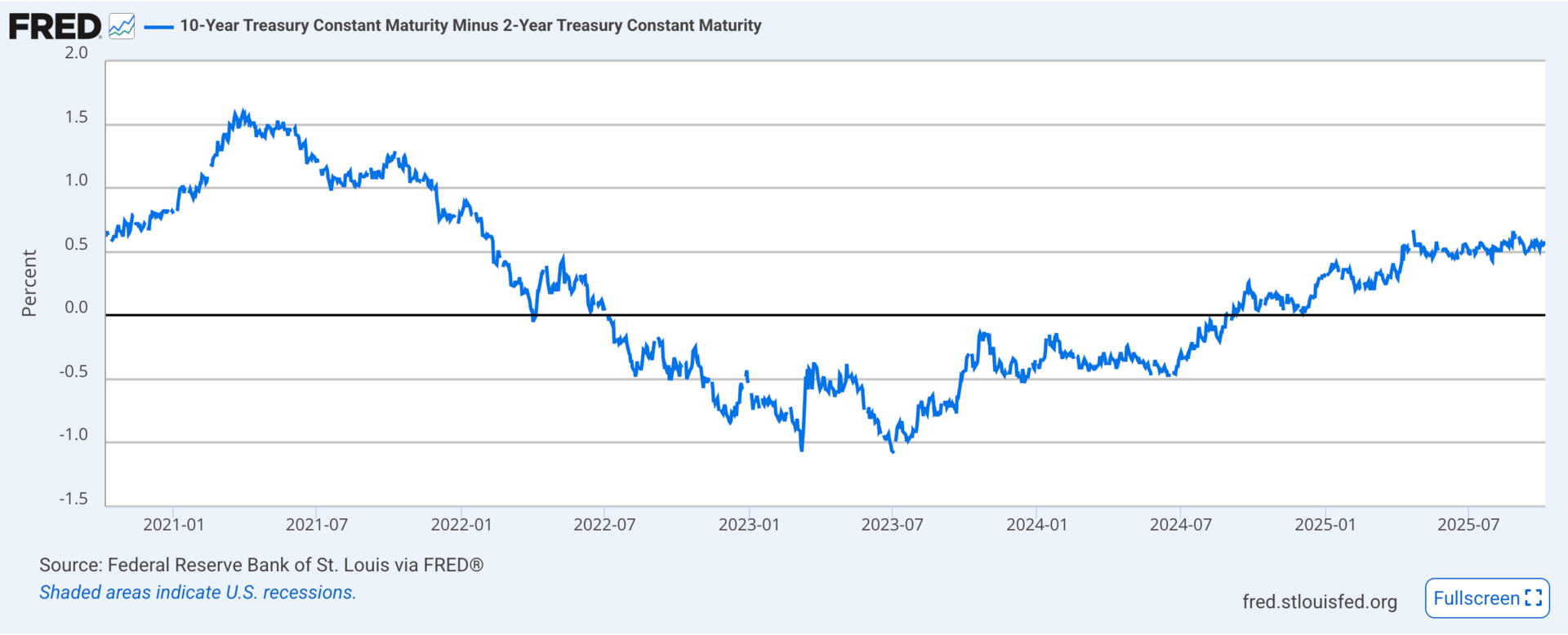

THE YIELD CURVE AND WHY I WATCH IT

The yield curve compares short term interest and long term interest. Normally long term pays more. But when short term pays more than long term we call that inversion

When the curve inverts it has a strong record of warning of a coming recession Often a recession follows within many months So when I see inversion I take extra care

I do not sell everything on the first sign of inversion I slow buying and move some money to safer spots while I watch other signs.

A PRACTICAL FAMILY STORY INDICATOR

I have a simple and unusual check I call the family talk indicator. I have noticed people close to me start talking like the market is great and everyone should jump in a few months before a big drop. This is human behavior at work. Many people get excited near the top so I listen to what friends family and neighbors are saying about easy money and instant winners. If everyone is overly excited I get cautious.

WHY I TRUST MULTIPLE CHECKS

Each check can be wrong. Sometimes one check is early and another is late. By using a few checks together I lower my chance of being badly wrong.

HOW THE 150 YEAR PATTERN RELATES TO REAL ESTATE CYCLE

There is another long cycle used for land and houses that repeats about 18.6 years. It looks at cycles of land value and housing markets.

The land cycle can have a middle peak and a final peak. The middle peak is often caused by financial excess like cheap loans. The final peak is more driven by land supply and by people from many income groups. When the final peak breaks the downturn can be wide and deep because it hits many people not just the rich.

WHAT CHANGED AFTER MAJOR WARS

Interestingly, according to new data from the 18.6 year real estate cycle, once you get to the Second World War (1945), for the 150 year cycle, the end-of-cycle peak switches from Row A to ‘Row B’. In other words, after the Second World War, Row A is the mid-cycle recessionary point of the real estate cycle, and Row B is the end-of-cycle peak.

Therefore, we can say that the Second World War switched the timing of the final peak of the US real estate cycle with the mid-cycle peak. It ‘interrupted’ its rhythm of boom and bust. Why? This is because war policies can easily stop booms and busts in the land market due to the government just changing their resource allocation, government spending, and economic priorities.

That’s why it’s very important to keep yourself up to date with data. This will help you understand when there will be a change in market momentums or cycles.

WHAT’S NEXT?

Looking at the dates on the Benner chart, Row B marks the next end of cycle real estate peak as ‘2026.’ Knowing that the Benner’s cycle chart can be 1 year off and basing off our other mentioned indicators, we are looking at a market peak around end of 2026 to mid 2027. This should give you a good timeframe to slowly reduce your position as we get near to that future.

If you find this article interesting, please let us know your thoughts down below here. We also have have other similar articles on our website too.

Tools I use

Sharing with you the tools I’m using at the moment.

Value Cycle Stock Investing Checklist v2026

This is the exact stock screening system I use to narrow thousands of companies down to just a few high-quality, high-conviction investments, growing my portfolio to $400k in 5 years.

📝 $5 When Join to Track investments, all assets and debt - WeMoney

📊 $15 OFF - TradingView (Charting Tool)

🧾 Crypto tax reports - Koinly

📈 33% OFF Track your investment performance and taxes - Sharesight

🧭 Why I’m Building the Smart X Capital Platform

I’m building something for investors who want to move smarter — not faster.

This isn’t for everyone. It’s for those who want to understand wealth through time, not tactics

A place where we’ll track these cycles together, share real-time insights, and learn how to invest with the cycle — not against it. I’ll be offering workshops, tutorials, and in-depth guides to help you build a timeless investing system that grows through every boom and bust.

📚 The Smart X Capital Platform is coming soon — a place to learn, connect, and stay ahead of every major market cycle using data, history, discipline and our community.

🚀 Be First to Join

If you’ve been following my emails and you want to be ready for 2026, now’s your moment.

Because when every major cycle converges — the prepared don’t panic. They profit.

Talk soon,

Ace — Smart X Capital’s Founder

Disclaimer: The information shared in this newsletter is for educational and informational purposes only. It is not financial advice, investment advice, or a recommendation to buy or sell any security or asset. Always do your own research or consult a licensed financial professional before making investment decisions.